For the 24 hours to 23:00 GMT, USD rose 0.58% against the CAD to close at 0.9749, as heightened risk aversion pushed commodities and global stocks lower and amid speculation that the Bank of Canada may raise interest rates.

The Bank of Canada Chief, Mark Carney, stated that the Canadian inflation would stay above the central bank’s target range in the second quarter of 2011. He also indicated that price pressures were temporary, due to the rise in gasoline price and provincial tax hikes.

In Canada, the manufacturing shipments registered a growth of 1.9% in March compared to the decline of 1.8% in February.

In the Asian session at 3:00GMT, the pair is trading at 0.9750, flat from the New York session close.

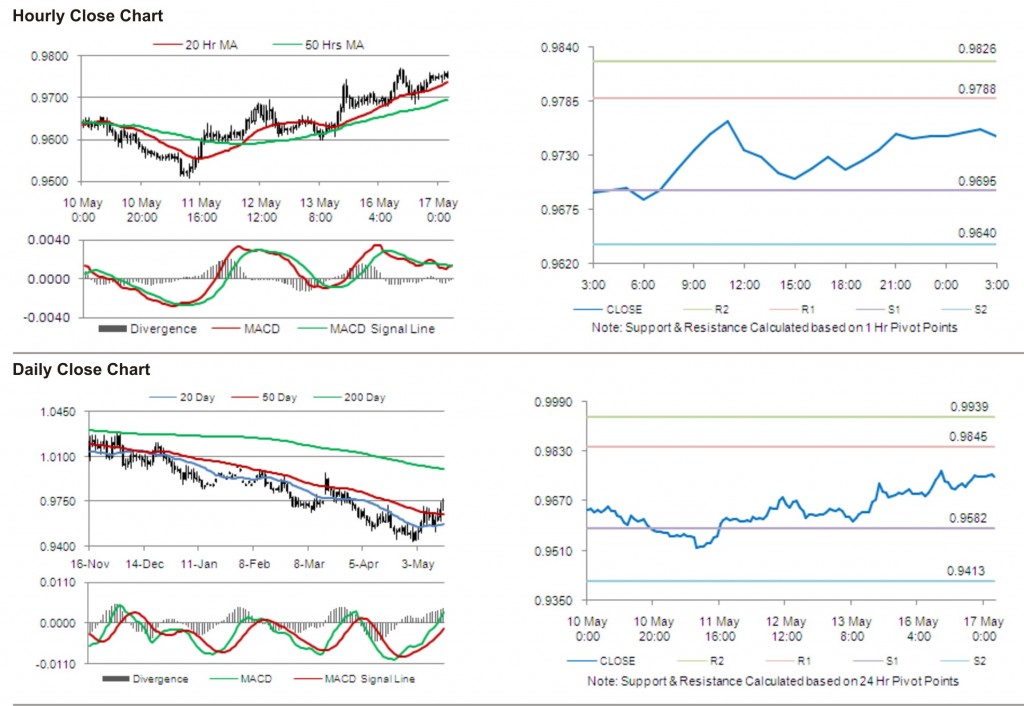

The first area of short term resistance is observed at 0.9788, followed by 0.9826 and 0.9919. The first area of support is at 0.9695, with the subsequent supports at 0.9640 and 0.9547.

Trading trends in the pair today are expected to be determined by data release of foreign investment in Canadian securities.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.