For the 24 hours to 23:00 GMT, the USD declined 0.33% against the CAD and closed at 1.3043.

The Bank of Canada (BoC) raised its key interest rate by 25 basis points to 1.75% for the fifth time since mid-2017, at par with market expectations. Further, the bank signalled more rate hikes, citing strength in the economy.

In the Asian session, at GMT0300, the pair is trading at 1.3025, with the USD trading 0.14% lower against the CAD from yesterday’s close.

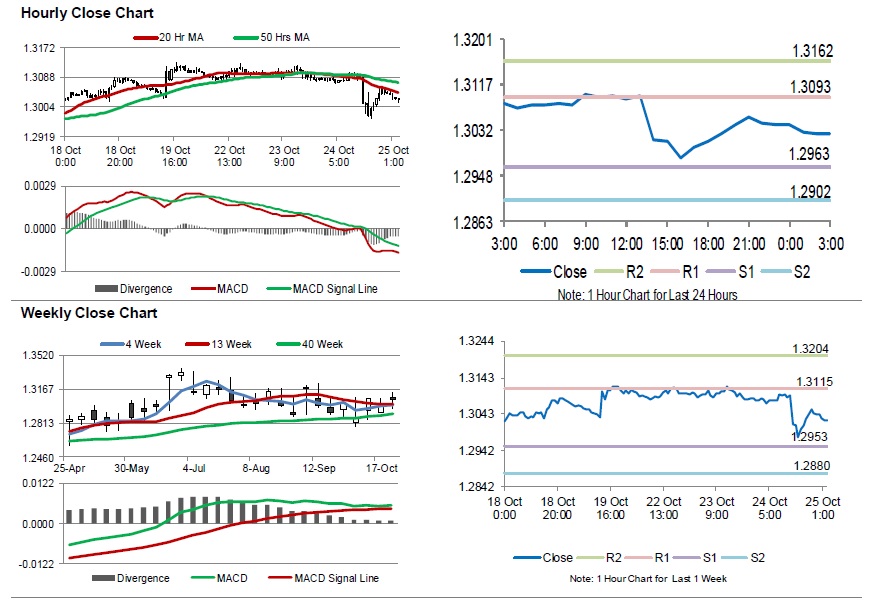

The pair is expected to find support at 1.2963, and a fall through could take it to the next support level of 1.2902. The pair is expected to find its first resistance at 1.3093, and a rise through could take it to the next resistance level of 1.3162.

Trading trend in the Loonie today is expected to be determined by Canada’s CFIB business barometer for October, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.