For the 24 hours to 23:00 GMT, the USD rose 1.45% against the CAD to close at 1.2915.

The CAD lost ground, after the BoC decided to slash its benchmark interest rate by 25 basis points to 0.5% – the second rate cut in six months. In a press conference, post the meeting, the BoC Governor, Stephen Poloz, expressed concerns over collapse in oil prices and slowing global economy and said that both have hit the Canadian economy significantly.

In other economic news, existing home sales in Canada dipped 0.8% MoM in June, compared to an increase of 3.1% in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.2929, with the USD trading 0.11% higher from yesterday’s close.

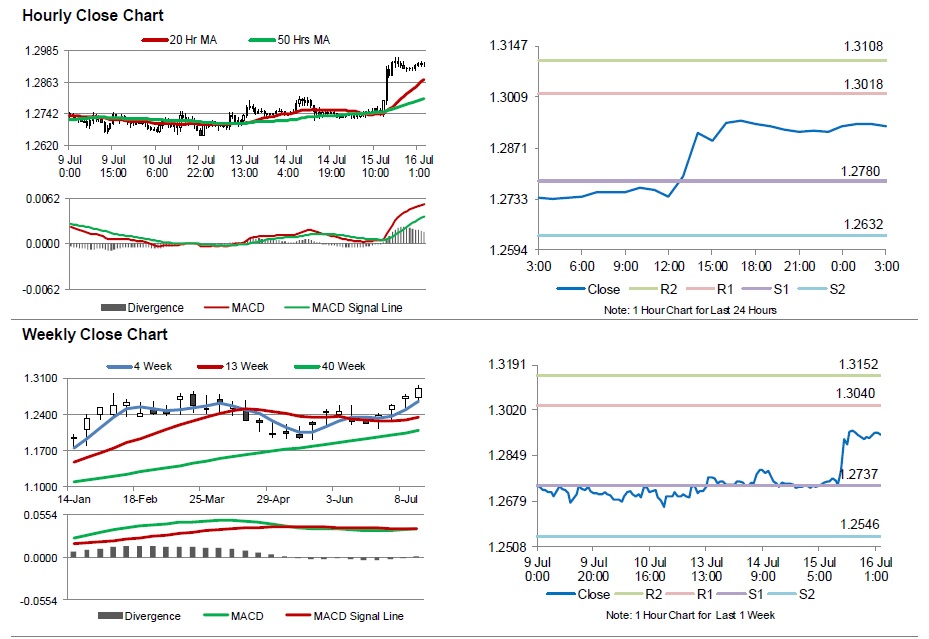

The pair is expected to find support at 1.2780, and a fall through could take it to the next support level of 1.2632. The pair is expected to find its first resistance at 1.3018, and a rise through could take it to the next resistance level of 1.3108.

With no major economic releases in Canada today, investors would focus on the nation’s consumer price inflation data, slated to release tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.