For the 24 hours to 23:00 GMT, the USD rose 1.99% against the CAD to close at 1.2351. The CAD lost ground after the BoC surprised markets by cutting its key interest rate by a quarter point to 0.75%, citing plunging oil prices being negative for the Canadian economy.

The central bank in its monetary policy report downgraded the nation’s economic growth projection to 2.1%, from its previous estimation of 2.4% growth. Additionally, it also cut its inflation projections and projected it to remain below 2% in 2015 and would start improving only in 2016.

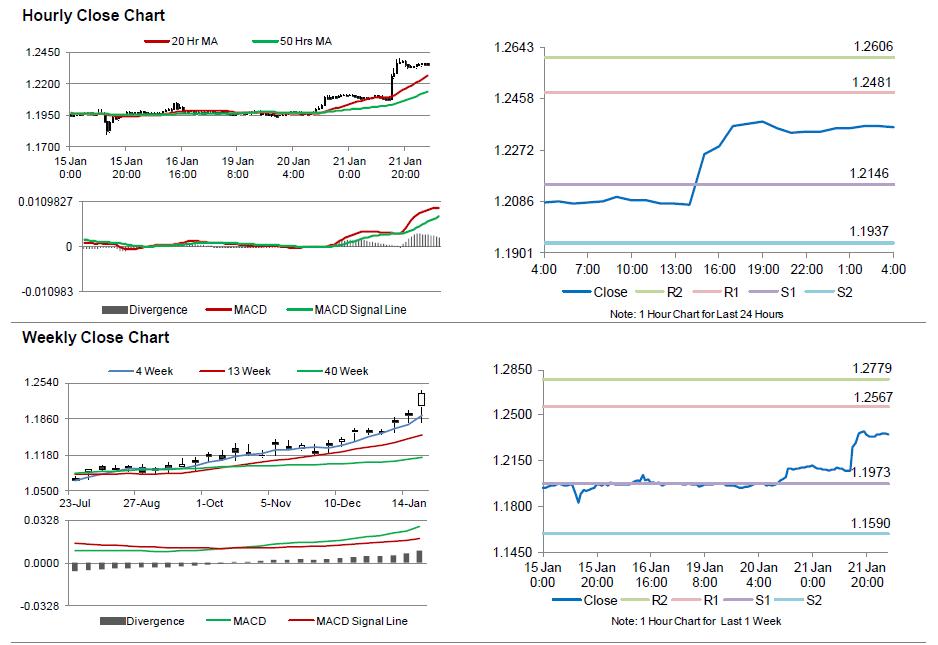

In the Asian session, at GMT0400, the pair is trading at 1.2356, with the USD trading 0.15% higher from yesterday’s close.

The pair is expected to find support at 1.2146, and a fall through could take it to the next support level of 1.1937. The pair is expected to find its first resistance at 1.2481, and a rise through could take it to the next resistance level of 1.2606.

Amid no economic releases in Canada today, investors await Canada’s CPI data scheduled for tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.