For the 24 hours to 23:00 GMT, the USD rose 1.10% against the CAD to close at 1.1074, following the release of the minutes from the Fed’s latest policy meeting, which indicated the policymaker’s stance for a continuation in tapering of the central bank’s QE measure.

The Canadian Dollar also came under pressure following a dismal domestic wholesale sales report, which showed that wholesale sales in Canada fell 1.4% (MoM) in December, more than analysts’ estimate for a 0.5% drop and compared to a 0.2% decrease recorded in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1078, with the USD trading slightly higher from yesterday’s close.

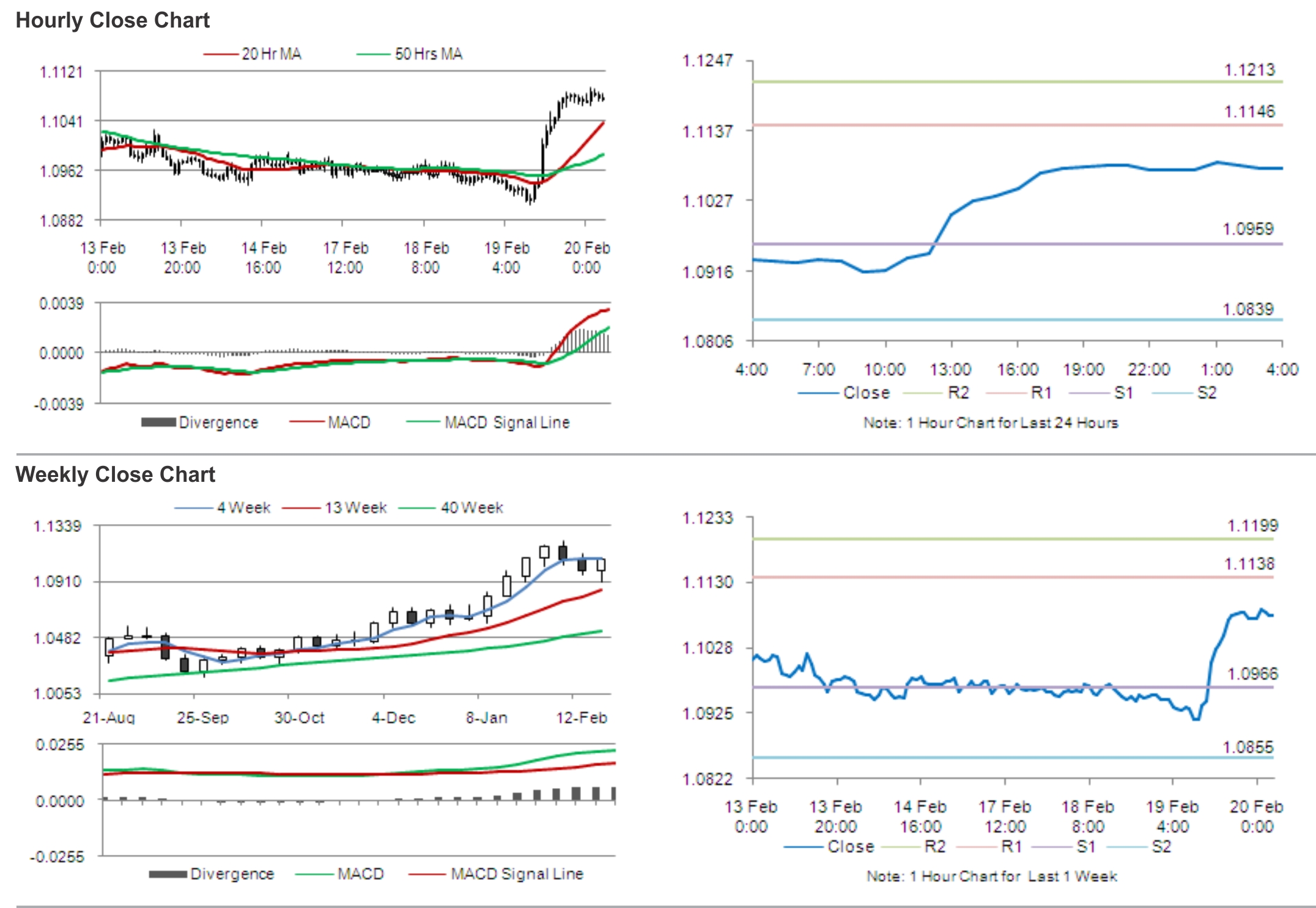

The pair is expected to find support at 1.0959, and a fall through could take it to the next support level of 1.0839. The pair is expected to find its first resistance at 1.1146, and a rise through could take it to the next resistance level of 1.1213.

Later today, the Bank of Canada (BoC) is expected to publish a quarterly review report on the economic conditions prevailing in the Canadian economy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.