For the 24 hours to 23:00 GMT, the USD traded flat against the CHF and closed at 1.0069.

Yesterday, data revealed that the Swiss SVME PMI edged up to a level of 54.0 in December, compared to previous month’s reading of 52.1 and while markets were expecting it to rise to 52.8.

Separately, the SNB Chairman, Thomas Jordan stated that the central bank’s cap on the Swiss Franc at 1.20 per Euro was appropriate in maintaining balanced monetary conditions in Switzerland as the nation was facing serious threat of low inflation. He further opined that the chances of Greece leaving the Euro area was very less, however if such a thing happens then innumerable risks would materialise.

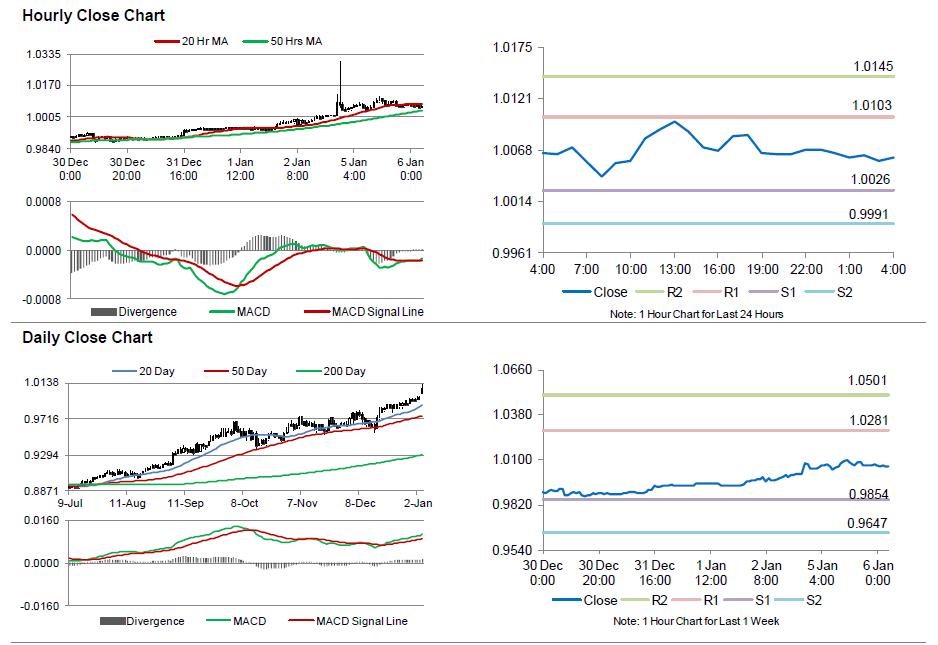

In the Asian session, at GMT0400, the pair is trading at 1.0061, with the USD trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.0026, and a fall through could take it to the next support level of 0.9991. The pair is expected to find its first resistance at 1.0103, and a rise through could take it to the next resistance level of 1.0145.

Amid no economic releases in Switzerland today, market participants look forward to Switzerland’s jobless rate data, scheduled later in the week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.