For the 24 hours to 23:00 GMT, USD rose 0.35% against the CHF and closed at 0.7958, as concerns over the weakening US economy eased after US data indicated a rise in durable-goods orders.

In the US, durable goods orders climbed 4.0% (M-o-M) to $201.5 billion in July, from an upwardly revised 1.3% drop in June. Meanwhile, non-defense capital goods orders excluding aircraft fell 1.5% (M-o-M) in July, compared to a 0.6% rise in June.

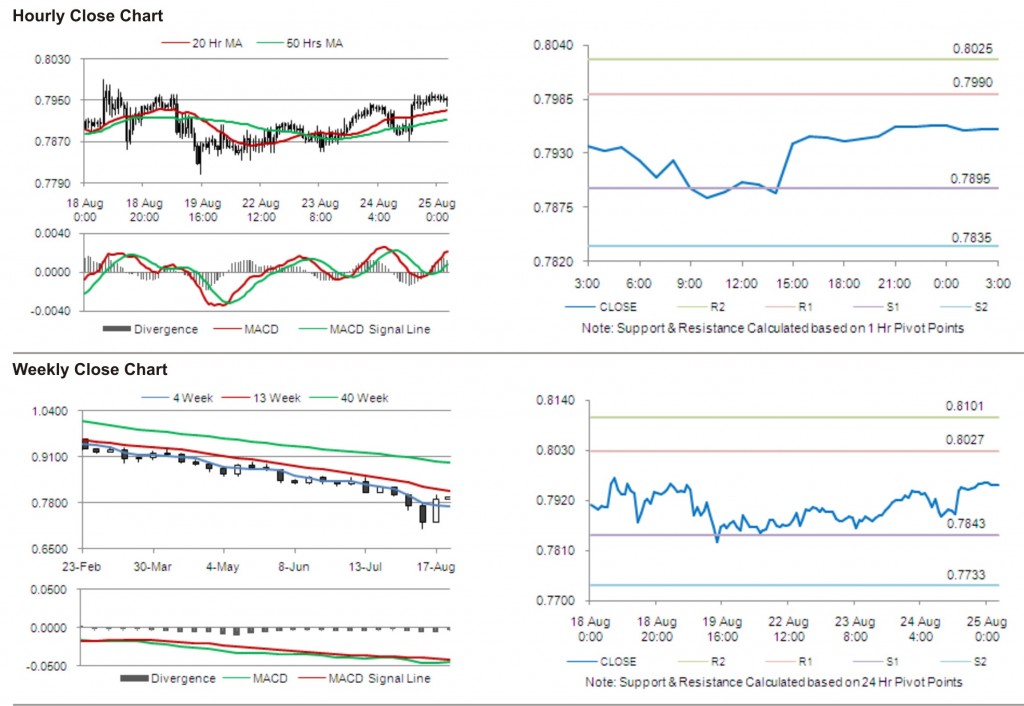

In the Asian session, at 3:00GMT, the pair is trading at 0.7954, 0.05% lower from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 0.7990, followed by the next resistance at 0.8025. The first area of support is at 0.7895 level, with the subsequent support at 0.7835.

With a series of Switzerland economic releases today, including economic expectations and employment level, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.