On Friday, the USD rose 0.13% against the CHF and closed at 0.8552. The Swiss Franc came under pressure, after real retail sales in Switzerland fell 1.2% on an annual basis in November. In the previous month, real retail sales had advanced by a revised 0.6%.

Meanwhile, on Sunday Swiss Finance Minister Eveline Widmer-Schlumpf assured the nation that the SNB’s recent decision would not hamper the economy ahead of an important week in which the ECB could announce a massive bond-buying program. She further stated that the exchange rate could settle down at around 1.10 per euro, a level which according to her the nation should be able to withstand.

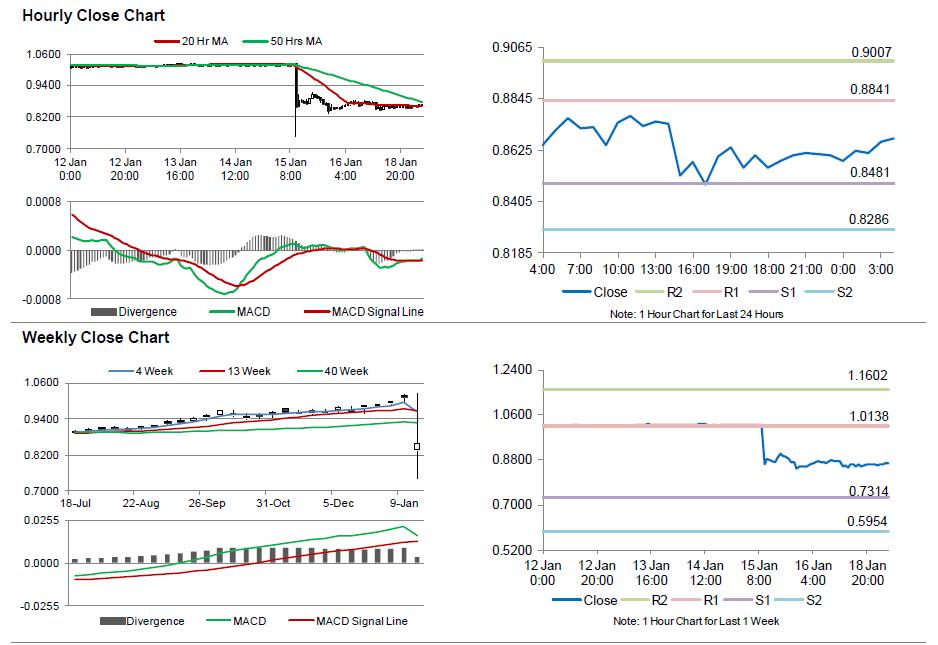

In the Asian session, at GMT0400, the pair is trading at 0.8675, with the USD trading 1.44% higher from Friday’s close.

The pair is expected to find support at 0.8481, and a fall through could take it to the next support level of 0.8286. The pair is expected to find its first resistance at 0.8841, and a rise through could take it to the next resistance level of 0.9007.

Amid a thin economic calendar in Switzerland today, investors await Switzerland’s producer and import prices data, scheduled in few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages,