For the 24 hours to 23:00 GMT, USD rose 0.52% against the CHF and closed at 0.8994.

In the US, the Federal Reserve Bank of Dallas in its Texas manufacturing outlook survey reported that its General Business Activity Index climbed to 17.8 in February, marking its highest level since November 2010. Moreover, the National Association of Realtors reported that the Pending Home Sales Index in the US rose 2.0% (MoM) to 97.0 in January, marking the highest level in almost two years.

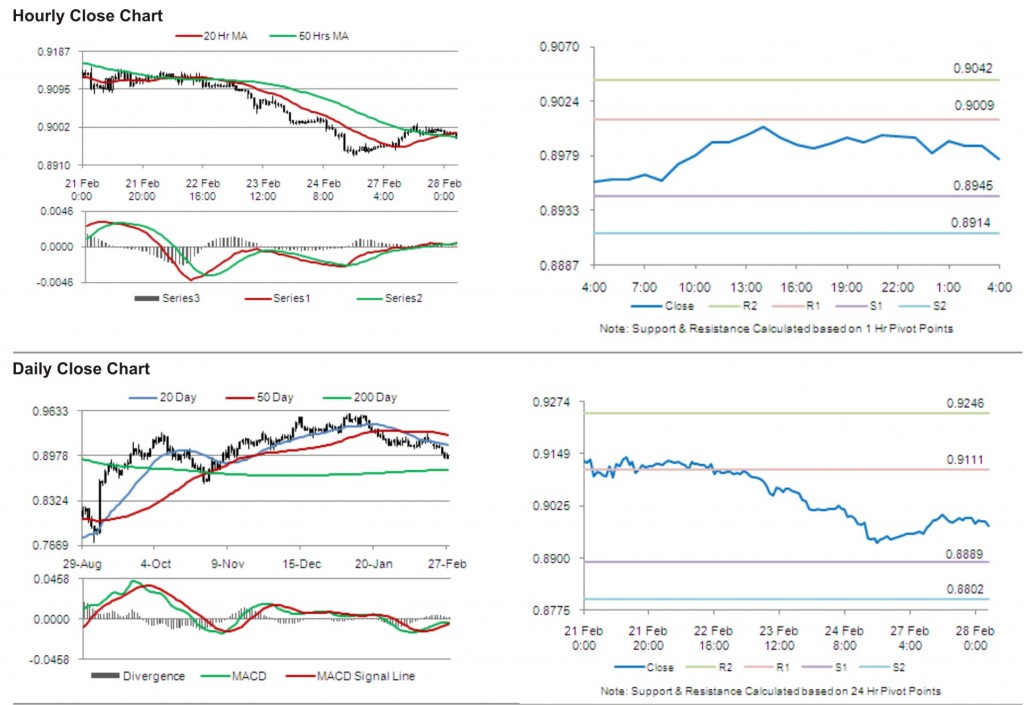

In the Asian session, at GMT0400, the pair is trading at 0.8976, with the USD trading 0.2% lower from yesterday’s close.

The pair is expected to find support at 0.8945, and a fall through could take it to the next support level of 0.8914. The pair is expected to find its first resistance at 0.9009, and a rise through could take it to the next resistance level of 0.9042.

CHF is likely to receive increased market attention, with Switzerland UBS Consumption Indicator due to be released later today.

The currency pair is converging with its 20 Hr and 50 Hr moving averages.