For the 24 hours to 23:00 GMT, the USD rose 0.54% against the CHF and closed at 1.0135.

Yesterday, the OECD warned that risks posed by negative interest rates have not materialized so far in Switzerland, although they are rising, notably for the financial sector and suggested authorities to stand ready to reinforce macroprudential measures, as mortgage rates are very low and debt is relatively high.

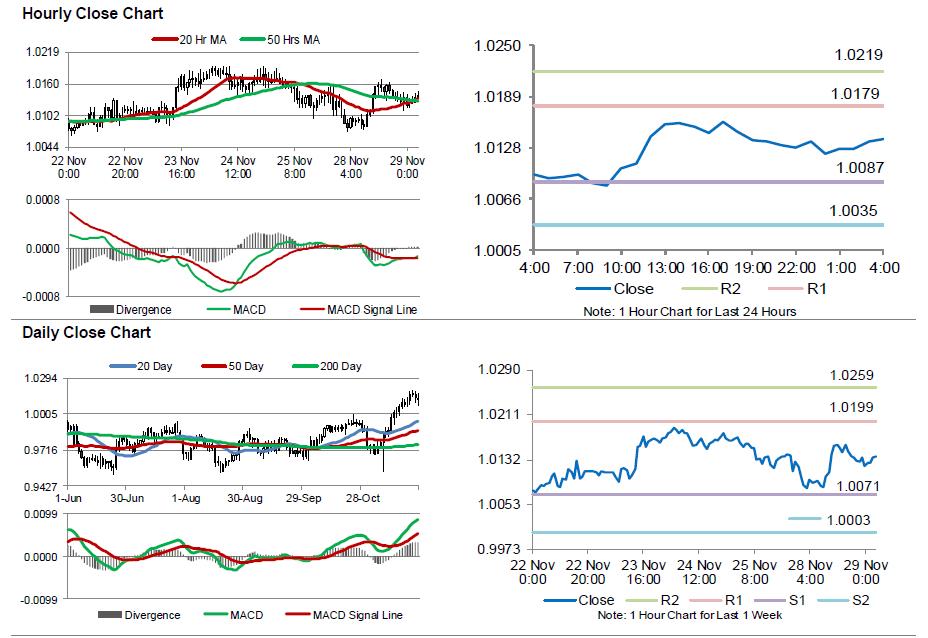

In the Asian session, at GMT0400, the pair is trading at 1.0138, with the USD trading marginally higher against the CHF from yesterday’s close.

The pair is expected to find support at 1.0087, and a fall through could take it to the next support level of 1.0035. The pair is expected to find its first resistance at 1.0179, and a rise through could take it to the next resistance level of 1.0219.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.