For the 24 hours to 23:00 GMT, the USD rose 0.37% against the CHF and closed at 0.9675.

Yesterday, the State Secretariat for Economic Affairs (SECO), in its quarterly economic forecasts report, raised Switzerland’s 2018 growth outlook to its highest level since 2010 to 2.9% higher than its earlier projection in June. However, the agency cited concerns over escalating global risks like trade dispute between the US, Italy’s anti-establishment government and Britain’s departure from the European Union.

In the Asian session, at GMT0300, the pair is trading at 0.9670, with the USD trading 0.05% lower against the CHF from yesterday’s close.

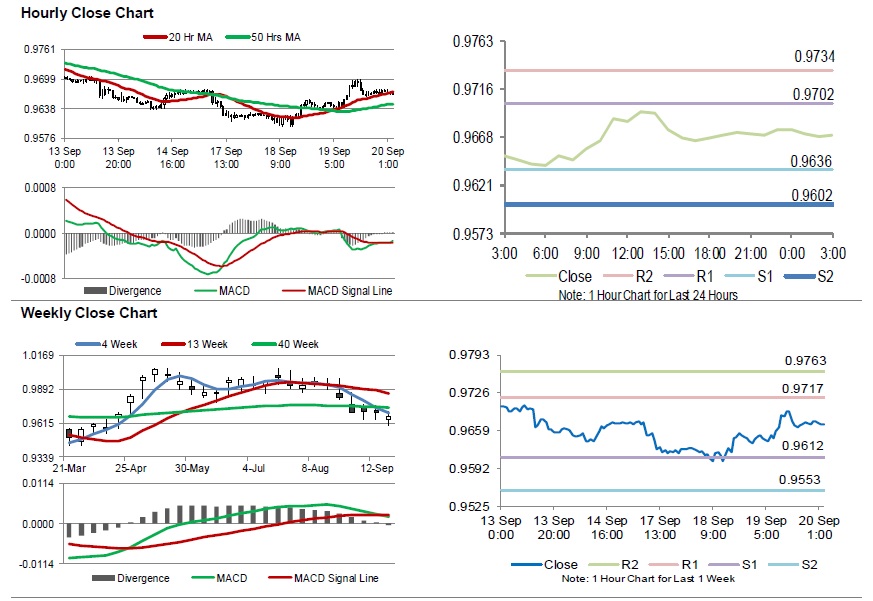

The pair is expected to find support at 0.9636, and a fall through could take it to the next support level of 0.9602. The pair is expected to find its first resistance at 0.9702, and a rise through could take it to the next resistance level of 0.9734.

Looking forward, investors would keep an eye on the Swiss National Bank’s (SNB) interest rate decision for September followed by trade balance data for August, both slated to release in a while.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.