For the 24 hours to 23:00 GMT, the USD rose 0.91% against the CHF and closed at 1.0299.

Yesterday, the Swiss National Bank (SNB) kept key interest rate unchanged at -0.75%. The SNB Chairman, Thomas Jordan stated that going further, it might become necessary to further lower rates in Switzerland from their current record-low levels and reiterated that the central bank would continue to remain active in the foreign exchange market, as necessary with the Swiss Franc still considered to be significantly overvalued. Further, the SNB slightly downgraded its inflation forecasts. It now sees 2017 inflation at 0.1% versus its previous September forecast of 0.2% and the 2018 estimate has been reduced slightly to 0.5% from 0.6%.

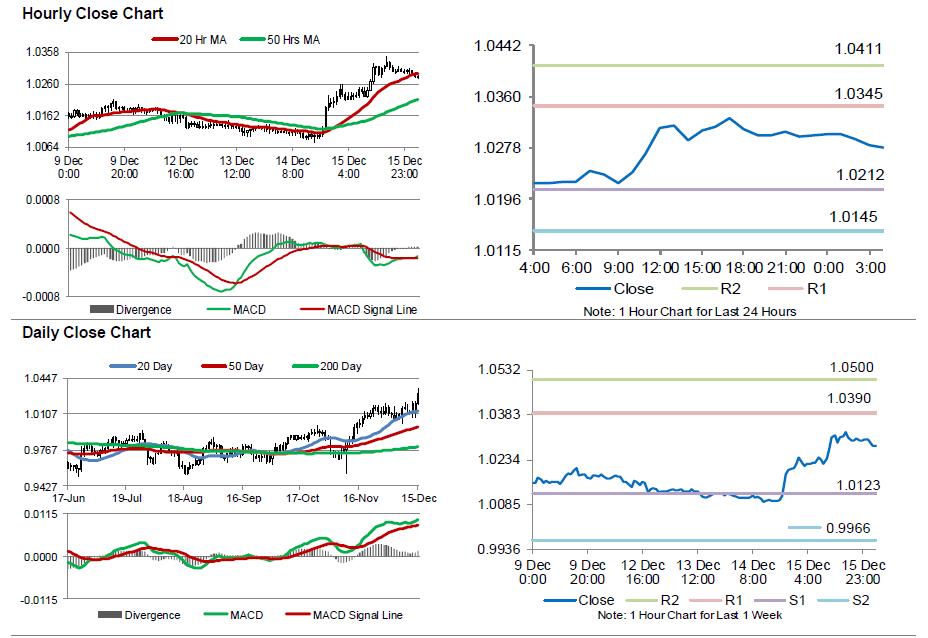

In the Asian session, at GMT0400, the pair is trading at 1.0279, with the USD trading 0.19% lower against the CHF from yesterday’s close.

The pair is expected to find support at 1.0212, and a fall through could take it to the next support level of 1.0145. The pair is expected to find its first resistance at 1.0345, and a rise through could take it to the next resistance level of 1.0411.

Moving ahead, investors will closely monitor Switzerland’s trade balance and KOF leading indicator index, both slated to release next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.