USD/CHF: SNB left its benchmark interest rate unchanged at -0.75%

For the 24 hours to 23:00 GMT, the USD rose 0.32% against the CHF and closed at 0.9854.

On the data front, Switzerland’s producer and import price index fell 2.5% on a yearly basis in November, more than market anticipation for a drop of 2.2%. In the previous month, the index had registered a decline of 2.4%.

The Swiss National Bank (SNB), in its latest policy meeting decided to leave its benchmark interest rate unchanged at -0.75%, as widely expected. The central bank maintained its inflation outlook at 0.4% in 2019 and downgraded inflation expectations for 2020 and 2021. Further, the SNB maintained its cautious outlook for country’s economy and stated that risks to the global economy remains tilted to the downside.

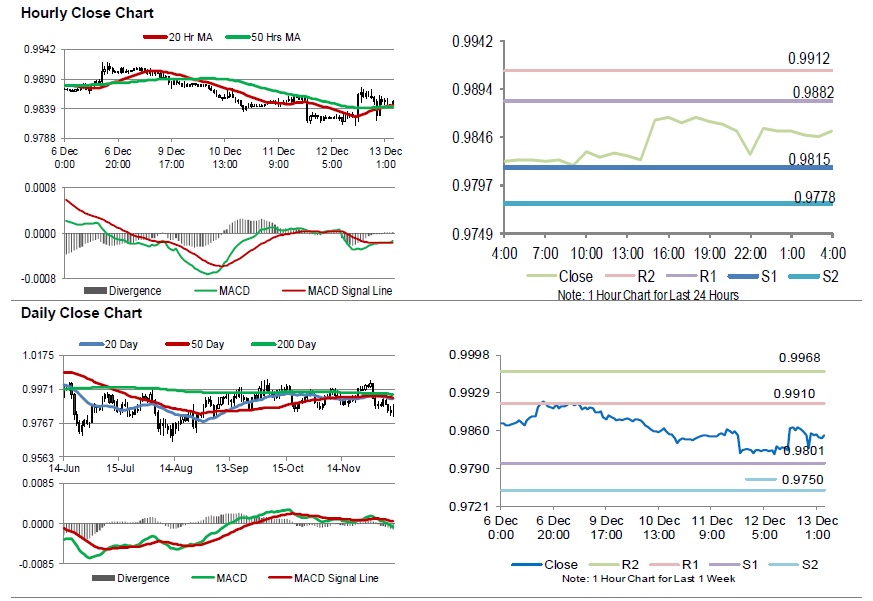

In the Asian session, at GMT0400, the pair is trading at 0.9851, with the USD trading a tad lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9815, and a fall through could take it to the next support level of 0.9778. The pair is expected to find its first resistance at 0.9882, and a rise through could take it to the next resistance level of 0.9912.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.