For the 24 hours to 23:00 GMT, the USD rose 0.50% against the CHF and closed at 0.9883.

Yesterday, the SNB kept benchmark interest rate steady at -0.75%, meeting market expectations, in a bid to prevent the “overvalued” franc from further appreciating. In a press conference that accompanied the decision, the central bank maintained its pledge to intervene in the foreign exchange market in order to influence the exchange rate situation, if necessary. Further, the central bank expects consumer prices to fall by 0.5% next year before rising in 2017, however less than its September forecast.

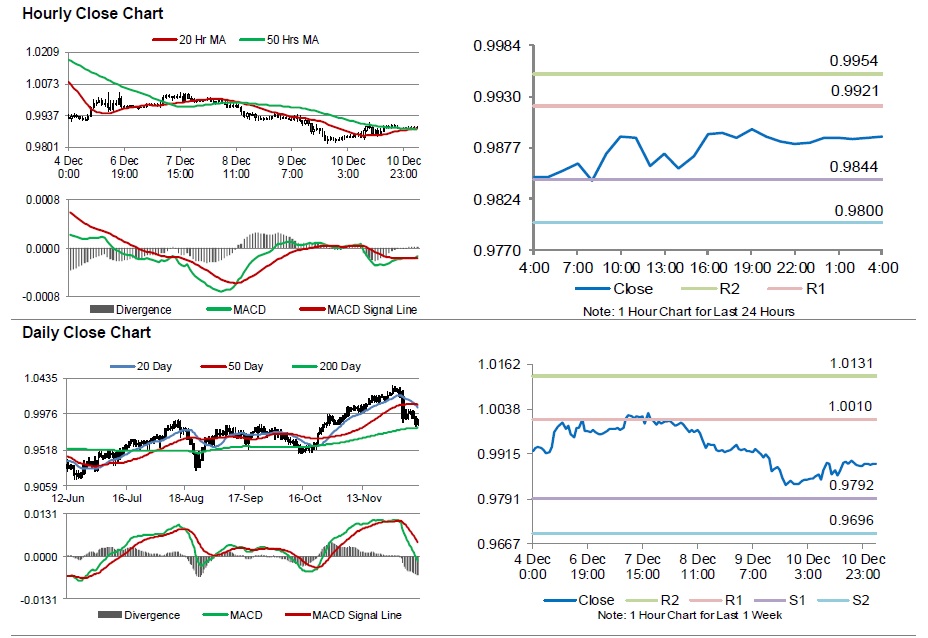

In the Asian session, at GMT0400, the pair is trading at 0.9888, with the USD trading marginally higher from yesterday’s close.

The pair is expected to find support at 0.9844, and a fall through could take it to the next support level of 0.9800. The pair is expected to find its first resistance at 0.9921, and a rise through could take it to the next resistance level of 0.9954.

Going ahead, market participants will look forward to Switzerland’s ZEW expectations survey and SECO economic forecast, scheduled to be released next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.