For the 24 hours to 23:00 GMT, the USD declined 0.26% against the CHF to close at 0.8940.

Yesterday, the SNB President, Thomas Jordan, at a press conference following the central bank’s decision to keep its interest rate unchanged interest rates at a near zero level and maintain its cap on Swiss Franc at 1.20 per Euro, hinted that Switzerland’s central bank stands well prepared to act if the ECB’s recent policy actions have an adverse impact on the economy. Furthermore, he projected the Swiss economy to continue with its moderate pace of recovery in coming quarters, despite an “extremely challenging” climate due to weak growth in the Euro area. Separately, the SNB, in its annual financial stability report, citing the low interest rate environment in the economy, urged authorities to “remain alert and take the necessary steps to keep financial risks in check” while highlighting the “risk of a further build-up of imbalances on the Swiss mortgage and real estate markets.”

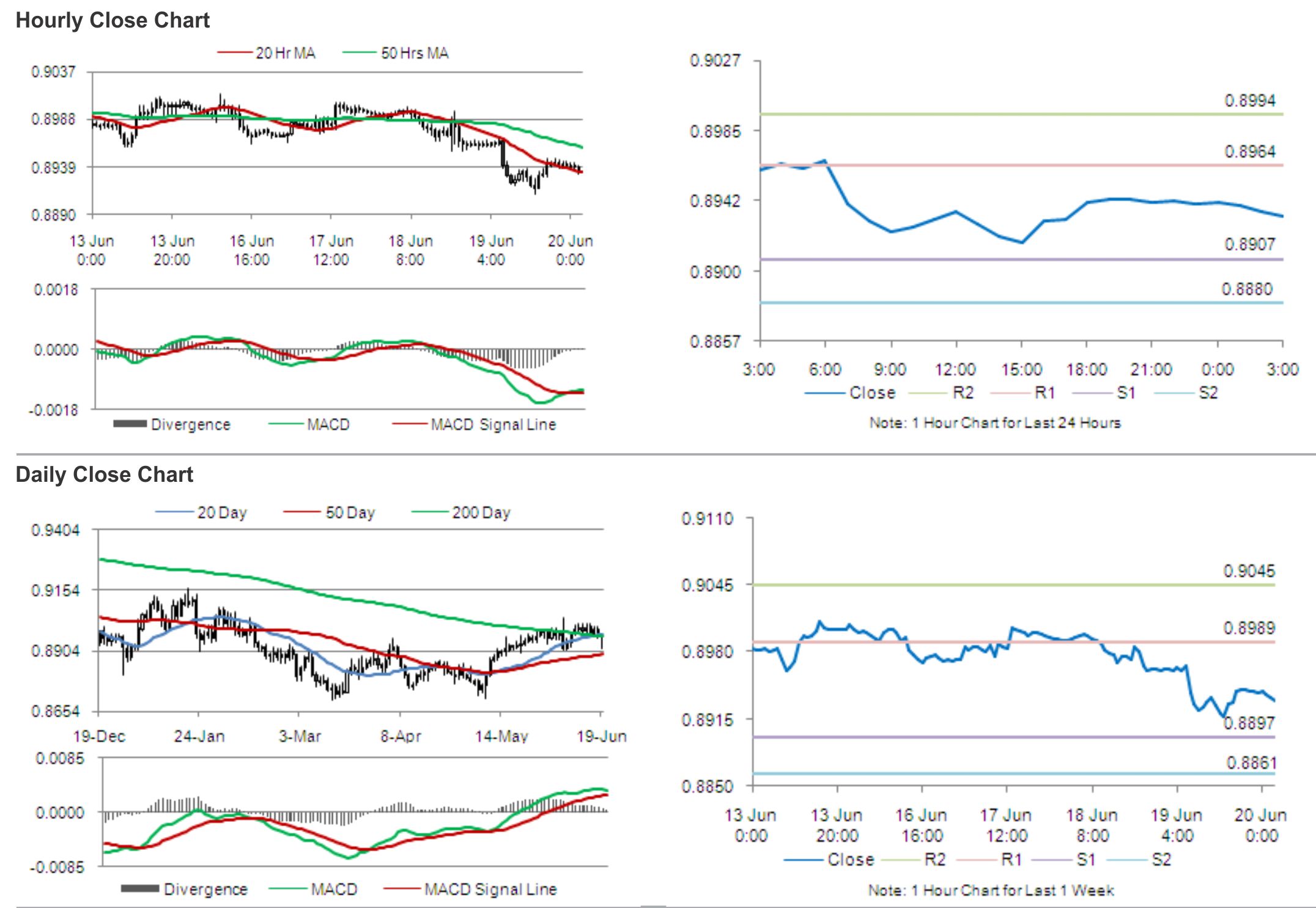

In the Asian session, at GMT0300, the pair is trading at 0.8933, with the USD trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 0.8907, and a fall through could take it to the next support level of 0.8880. The pair is expected to find its first resistance at 0.8964, and a rise through could take it to the next resistance level of 0.8994.

With no major economic releases in Switzerland, later today, traders are expected to keep a tab on next week’s crucial, UBS consumption and KOF leading indicators.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.