For the 24 hours to 23:00 GMT, the USD declined 0.16% against the CHF and closed at 0.8809, hurt by a lacklustre US Markit manufacturing PMI data.

Yesterday, the IMF urged the Swiss National Bank (SNB) to stick to its policy of defending its exchange-rate floor as a further appreciation in the Swiss Franc could trigger deflationary risks in the economy. The IMF opined that the Swiss Franc at current level still remained moderately overvalued and suggested the SNB to consider introducing negative interest rates on banks’ excess reserves to combat the possibility of a further rise in the value of the Franc.

Meanwhile, the SNB Head of Economic Affairs, Thomas Moser agreed with the IMF’s opinion on the Swiss France being over valued and assured that the central bank would make proper arrangements to defend the floor if necessary.

In the Asian session, at GMT0400, the pair is trading at 0.8809, with the USD trading flat from yesterday’s close.

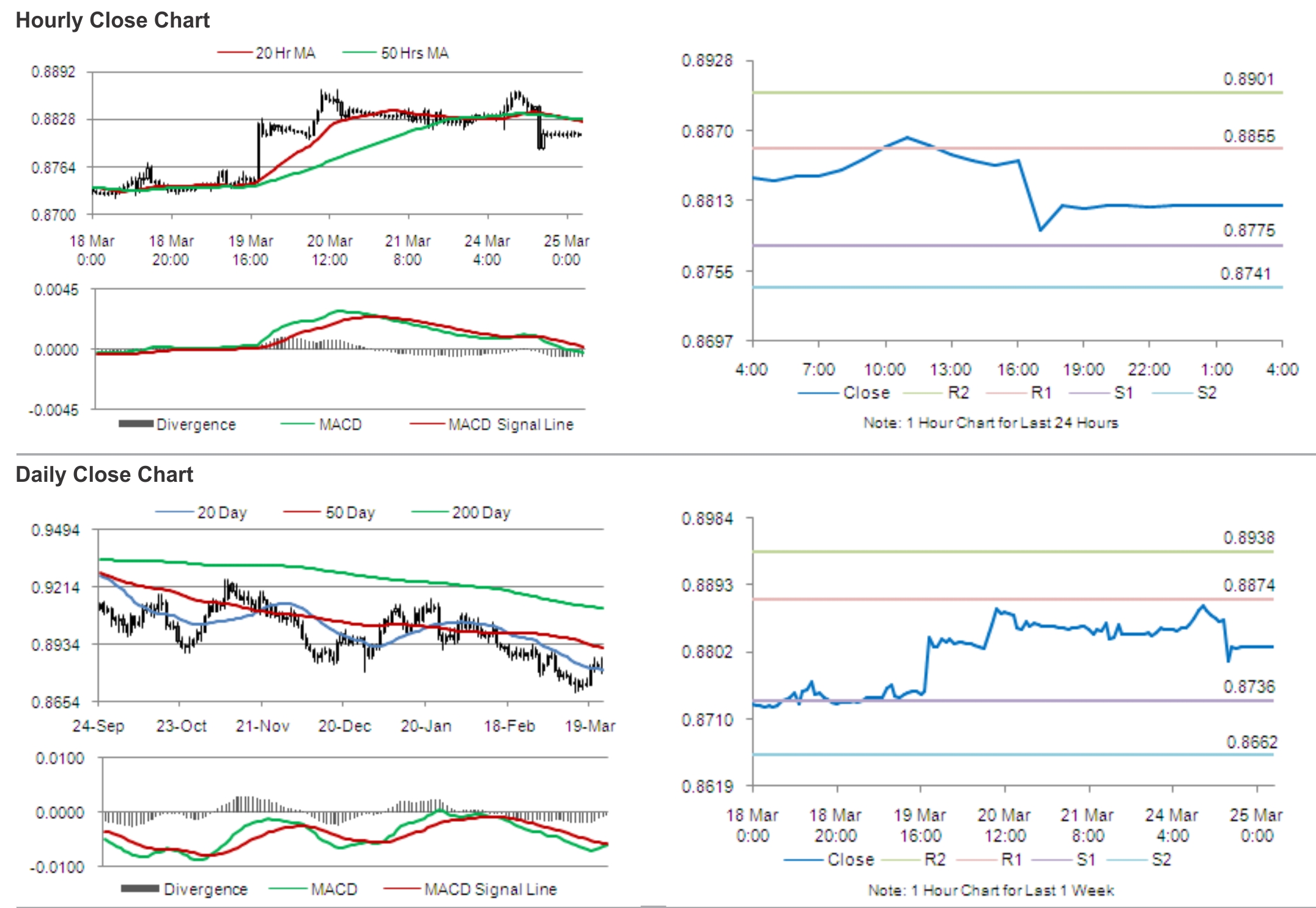

The pair is expected to find support at 0.8775, and a fall through could take it to the next support level of 0.8741. The pair is expected to find its first resistance at 0.8855, and a rise through could take it to the next resistance level of 0.8901.

Amid lack of major economic releases in Switzerland, traders eye global economic news for further cues in the pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.