For the 24 hours to 23:00 GMT, the USD rose 0.21% against the CHF and closed at 1.0193.

The Swiss Franc declined against the US dollar, amid dismal economic data

Data showed that Switzerland’s SVME manufacturing PMI unexpectedly contracted to a level of 48.5 in April, compared to a level of 50.3 in the previous month. Market participants had envisaged the PMI to register a rise to a level of 51.0. Moreover, the nation’s real retail sales eased 0.7% on an annual basis in March, higher than market anticipation for a fall of 0.4%. In the previous month, real retail sales had recorded a revised unchanged reading.

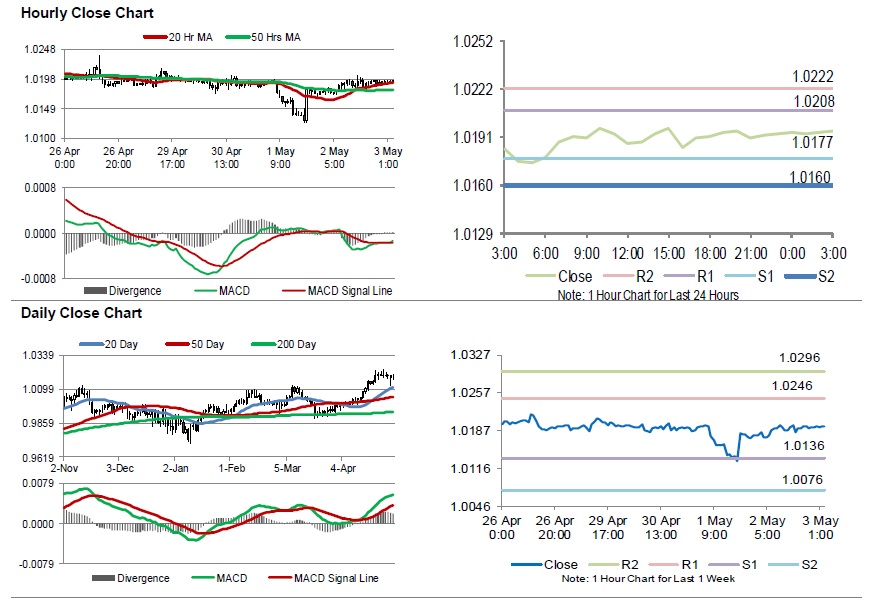

In the Asian session, at GMT0300, the pair is trading at 1.0195, with the USD trading a tad higher against the CHF from yesterday’s close.

The pair is expected to find support at 1.0177, and a fall through could take it to the next support level of 1.0160. The pair is expected to find its first resistance at 1.0208, and a rise through could take it to the next resistance level of 1.0222.

Looking ahead, traders would await Switzerland’s SECO consumer confidence index and the consumer price index for April, slated to release in a while.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.