For the 24 hours to 23:00 GMT, the USD rose 0.26% against the CHF and closed at 0.9008, following hawkish comments from the St. Louis Fed President, James Bullard, who indicated that the Fed would persist with its tapering of the Fed’ s stimulus measure, despite the latest batch of downbeat economic data from the US economy. He further added that the central would once again come back to its “traditional” policy-making now that the jobless rate in the nation has fallen to 6.6%, a tad above the Fed’s existing 6.5% threshold for considering an interest-rate rise.

In Switzerland, the annual consumer inflation rate stood at previous month’s level of 0.1% in January, broadly in-line with market expectations.

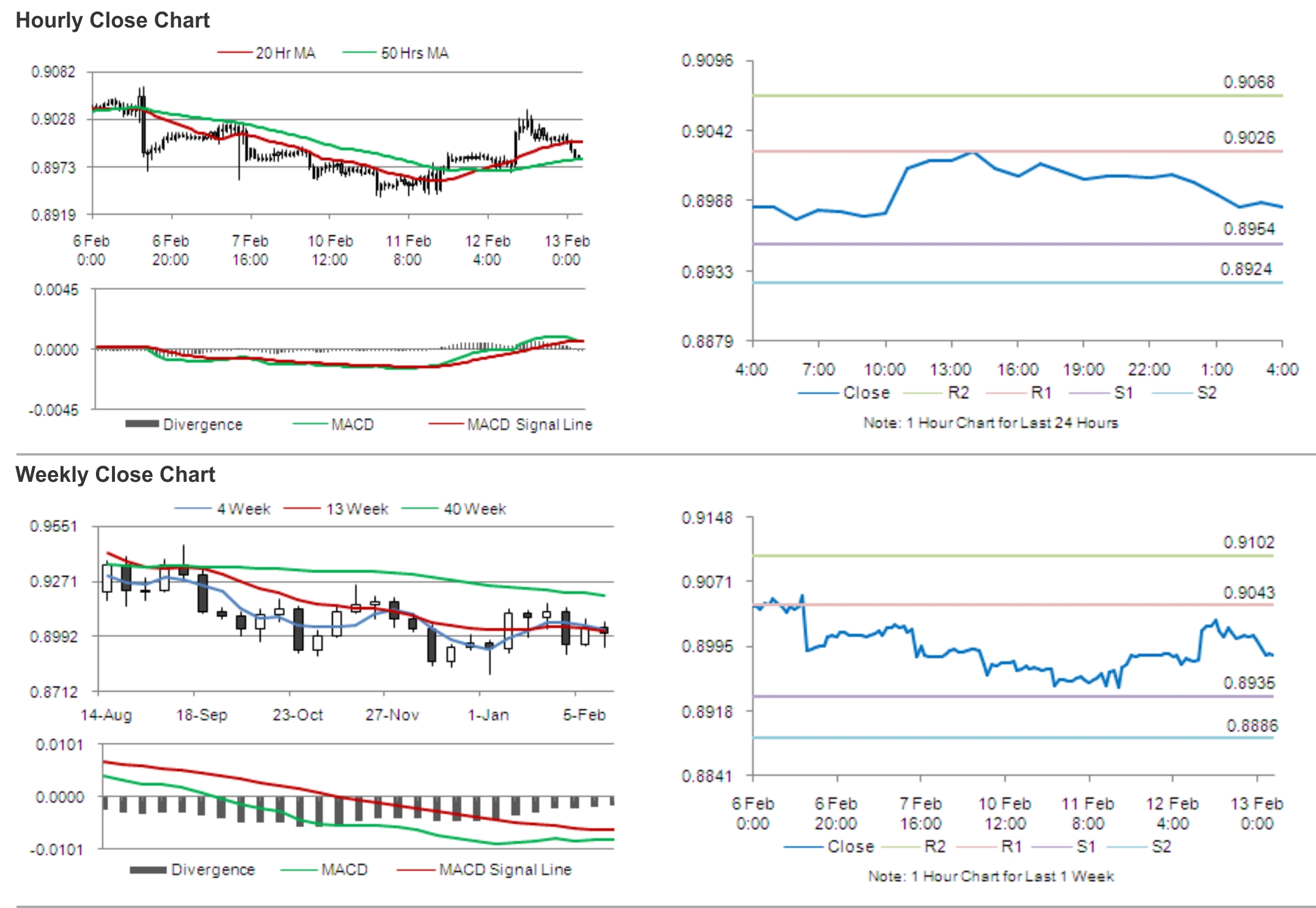

In the Asian session, at GMT0400, the pair is trading at 0.8983, with the USD trading 0.28% lower from yesterday’s close.

The pair is expected to find support at 0.8954, and a fall through could take it to the next support level of 0.8924. The pair is expected to find its first resistance at 0.9026, and a rise through could take it to the next resistance level of 0.9068.

Later today, the Federal Statistical Office is expected to report the trend in Switzerland’s producer and import prices for January, which is expected to stay pat in sync with yesterday’s inflation numbers.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.