For the 24 hours to 23:00 GMT, the USD rose 0.73% against the CHF and closed at 0.9807.

The Swiss Franc lost ground, after Switzerland’s consumer price index (CPI) unexpectedly fell by 0.2% on an annual basis in September, defying market expectations for it to show a flat reading. In the prior month, the CPI had registered a drop of 0.1%.

Separately, the KOF Swiss Economic Institute, upgraded Switzerland’s growth projection for this year, as the economy showed signs of pick up after a dry spell. It now projects the Swiss economy to expand by 1.6%, from an earlier estimate of 1.0%. It also forecasted the nation’s economic growth to edge up to 1.8% and 1.9% in 2017 and 2018 respectively.

In the Asian session, at GMT0300, the pair is trading at 0.9821, with the USD trading 0.14% higher against the CHF from yesterday’s close.

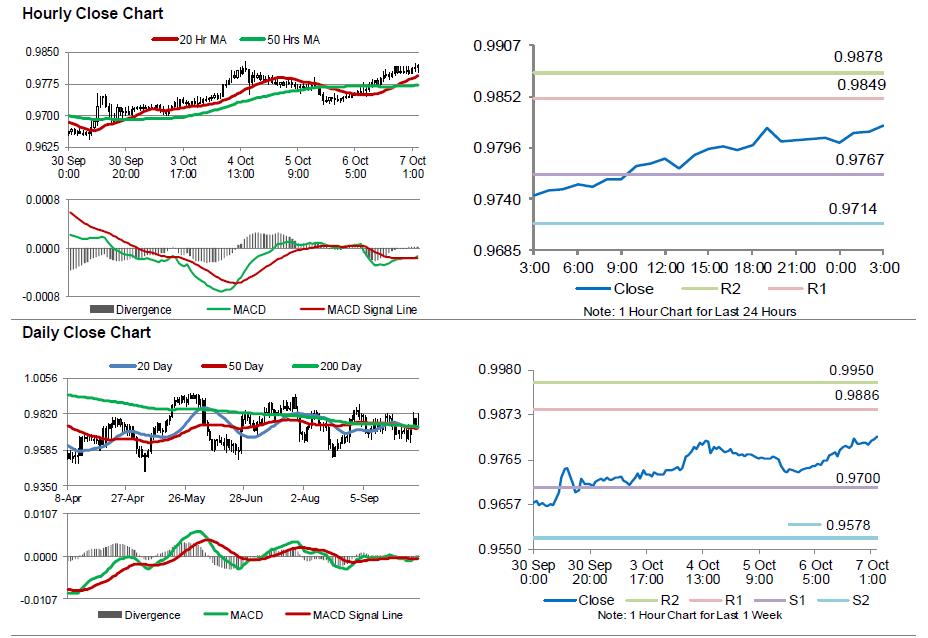

The pair is expected to find support at 0.9767, and a fall through could take it to the next support level of 0.9714. The pair is expected to find its first resistance at 0.9849, and a rise through could take it to the next resistance level of 0.9878.

With no economic releases in Switzerland today, investors would focus on Switzerland’s unemployment rate for September and ZEW survey for expectations data for October, scheduled next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.