For the 24 hours to 23:00 GMT, the USD rose 0.13% against the CHF and closed at 1.0052.

Macroeconomic data revealed that Switzerland’s consumer price index (CPI) rose 0.2% MoM in March, meeting market expectations. The CPI had climbed 0.5% in the previous month. Meanwhile, on an annual basis, the CPI surprisingly remained steady at 0.6% in March.

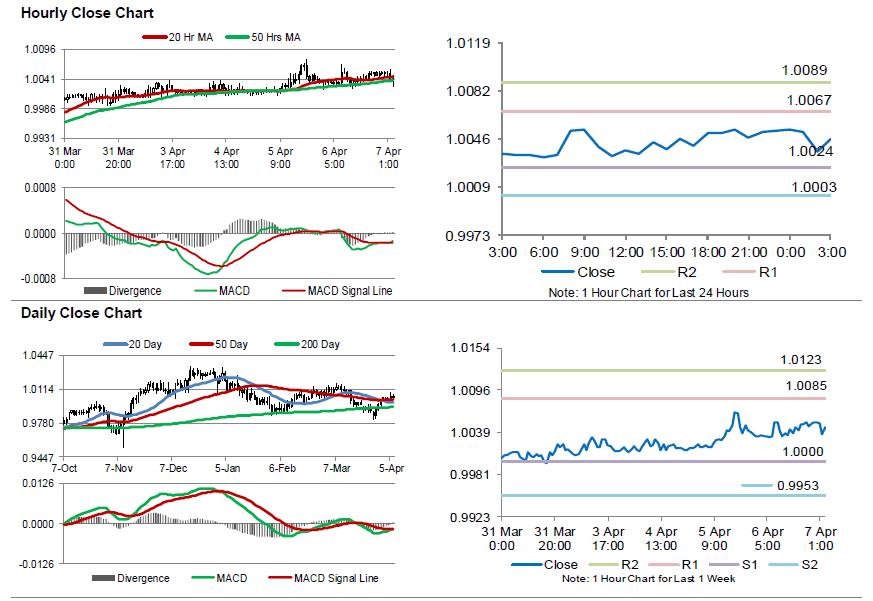

In the Asian session, at GMT0300, the pair is trading at 1.0046, with the USD trading 0.06% lower against the CHF from yesterday’s close.

The pair is expected to find support at 1.0024, and a fall through could take it to the next support level of 1.0003. The pair is expected to find its first resistance at 1.0067, and a rise through could take it to the next resistance level of 1.0089.

Going ahead, market participants focus on Switzerland’s unemployment rate for March, due to release in a few hours, to gauge strength in the nation’s labour market.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.