For the 24 hours to 23:00 GMT, USD rose 0.25% against the CHF and closed at 0.8883.

Swiss franc fell against the greenback amid speculation that the Swiss National Bank policy makers may further impose a tighter target to control currency strength.

The State Secretariat for Economic Affairs (SECO) cut its 2011 growth projection for Switzerland to 1.9%, down from the prior estimate of 2.1%. Additionally, the agency lowered its 2012 growth forecast to 0.9%, compared to the previous estimate of 1.5%.

In the economic news, the trade surplus narrowed in Switzerland to CHF 808.0 million in August, compared to a surplus of CHF 2.8 billion posted in the previous month.

In the Asian session, at 3:00GMT, the USD is trading at 0.8870, 0.15% lower versus Swiss Franc, from yesterday’s close at 23:00 GMT.

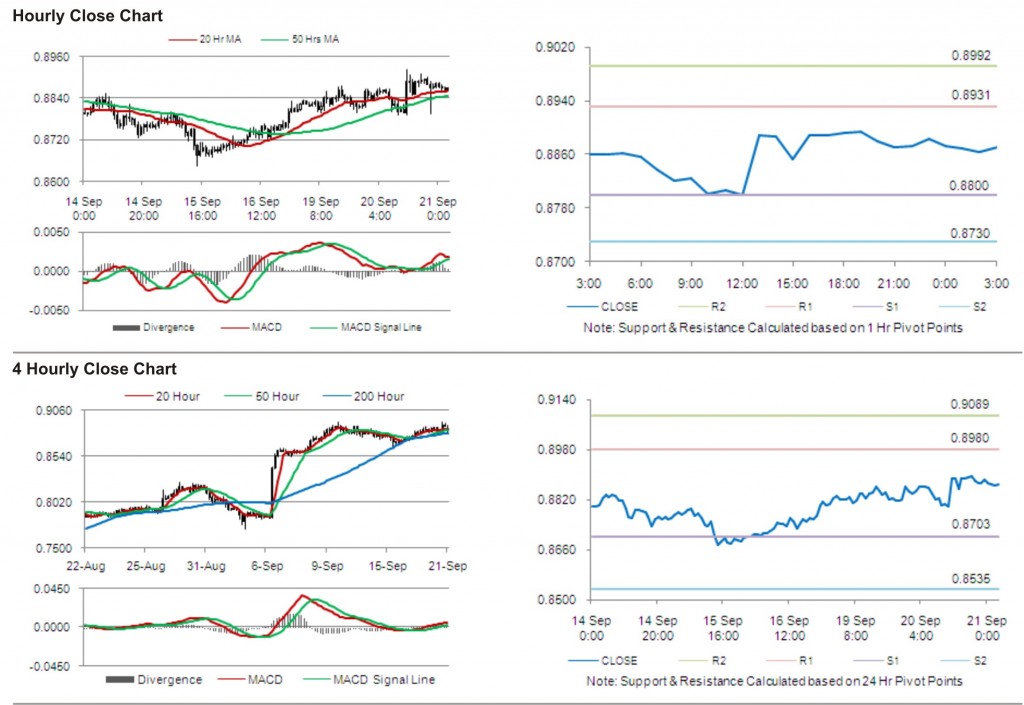

The pair has its first short term resistance at 0.8931, followed by the next resistance at 0.8992. The first area of support is at 0.8800 level, with the subsequent support at 0.8730.

The pair is expected to trade on the cues from the release of data of money supply in Switzerland.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.