For the 24 hours to 23:00 GMT, the USD declined 1.11% against the CHF and closed at 0.9691.

Macroeconomic data indicated that, Switzerland’s KOF leading indicator slightly advanced to a level of 102.7 in July, compared to a revised reading of 102.6 in the prior month and beating market expectations for it to ease to a level of 101.4.

In the Asian session, at GMT0300, the pair is trading at 0.9689, with the USD trading marginally lower against the CHF from Friday’s close.

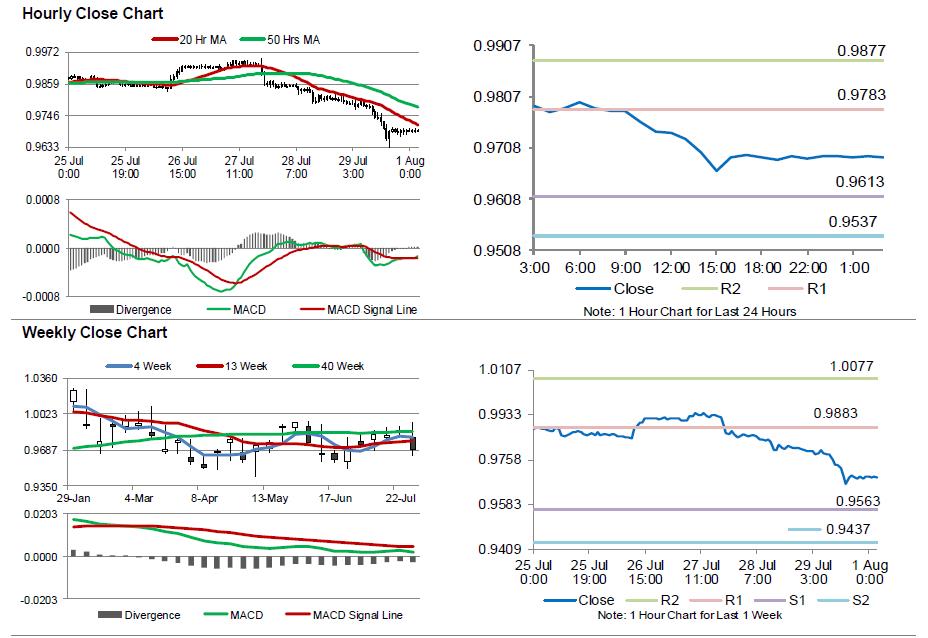

The pair is expected to find support at 0.9613, and a fall through could take it to the next support level of 0.9537. The pair is expected to find its first resistance at 0.9783, and a rise through could take it to the next resistance level of 0.9877.

As Switzerland observes a national holiday today, the pair would seek direction through global events.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.