For the 24 hours to 23:00 GMT, USD rose 4.86% against the CHF and closed at 0.7615.

Swiss franc nursed heavy losses yesterday, sparked by a Swiss newspaper report that quoted Swiss National Bank (SNB), Vice Chairman Thomas Jordan stating the central bank could ease monetary policy further.

He stated that the country could legally peg the Swiss Franc to the Euro temporarily to stem its strength.

In the US, trade deficit widened unexpectedly to $53.1 billion in June, the highest level since October 2008, and compared to a revised trade deficit of $50.8 billion in May.

In the Asian session, at 3:00GMT, the pair is trading at 0.7612, flat from yesterday’s close at 23:00 GMT.

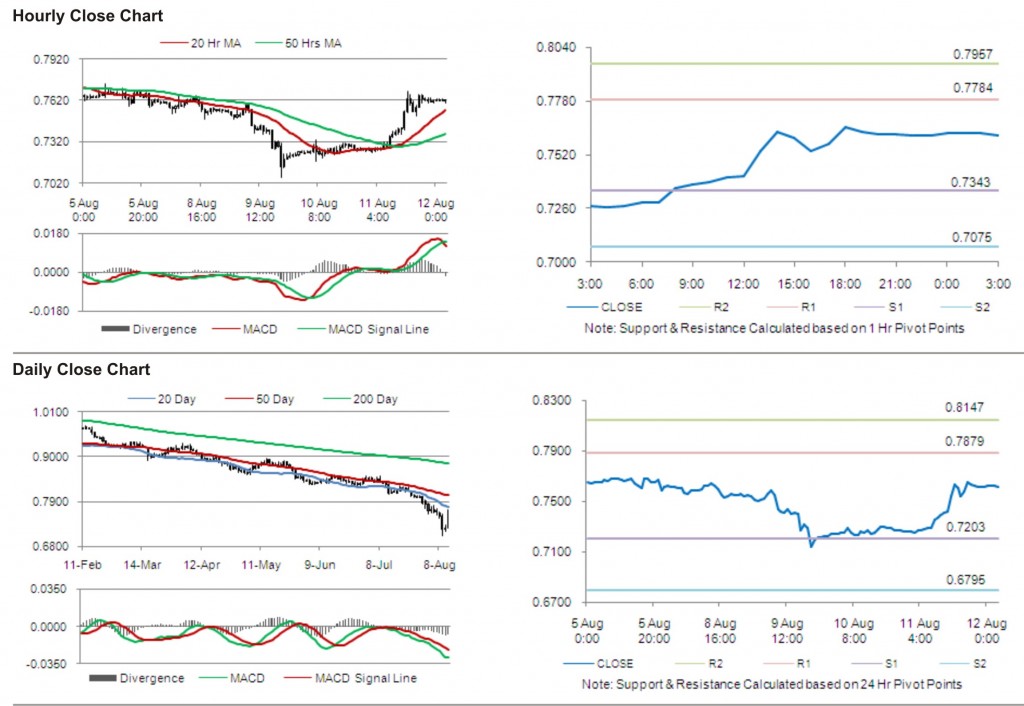

The pair has its first short term resistance at 0.7784, followed by the next resistance at 0.7957. The first area of support is at 0.7343 level, with the subsequent support at 0.7075.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.