For the 24 hours to 23:00 GMT, USD declined 1.20% against the CHF and closed at 0.8961.

The import prices in the US, on monthly basis, rose 2.7% in March, the fastest rate of import price growth since June 2009, following a 1.4% increase recorded in the previous month. The trade deficit in the US narrowed to $45.8 billion in February, following a revised deficit of $47.0 billion recorded in January.

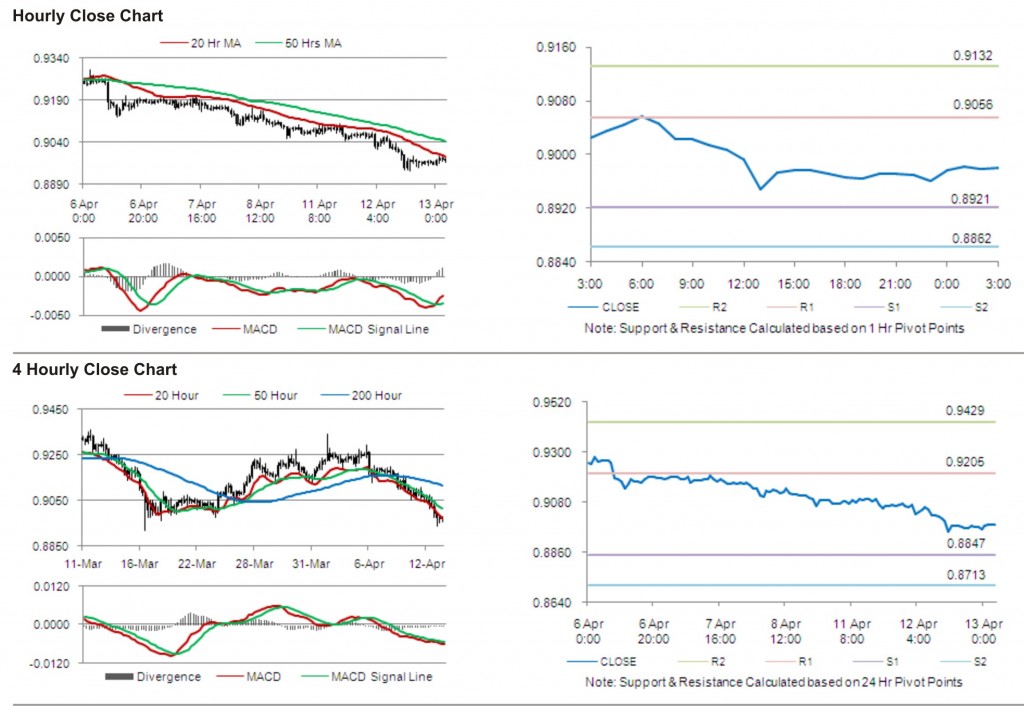

In the Asian session, at 3:00GMT, the pair is trading at 0.8980, 0.21% higher from the New York session close.

The pair has its first short term resistance at 0.9056, followed by the next resistance at 0.9132. The first area of support is at 0.8921 levels, with the subsequent support at 0.8862.

Trading trends in the pair today are expected to be determined by data release on producer and import prices in Switzerland.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.