For the 24 hours to 23:00 GMT, USD rose 0.84% against the CHF, on Friday, and closed at 0.8858.

In the economic news in Switzerland, the foreign currency reserves declined to CHF 242.7 billion compared to CHF 282.2 billion in September.

In the Asian session, at GMT0400, the pair is trading at 0.8935, with the USD trading 0.87% higher from Friday’s close, following the SNB President’s statement. The Swiss National Bank (SNB) President Philipp Hildebrand, yesterday, stated that SNB policy makers would remain ready to act in case the Swiss franc’s strength increases the risk of deflation and threatens the country’s economy.

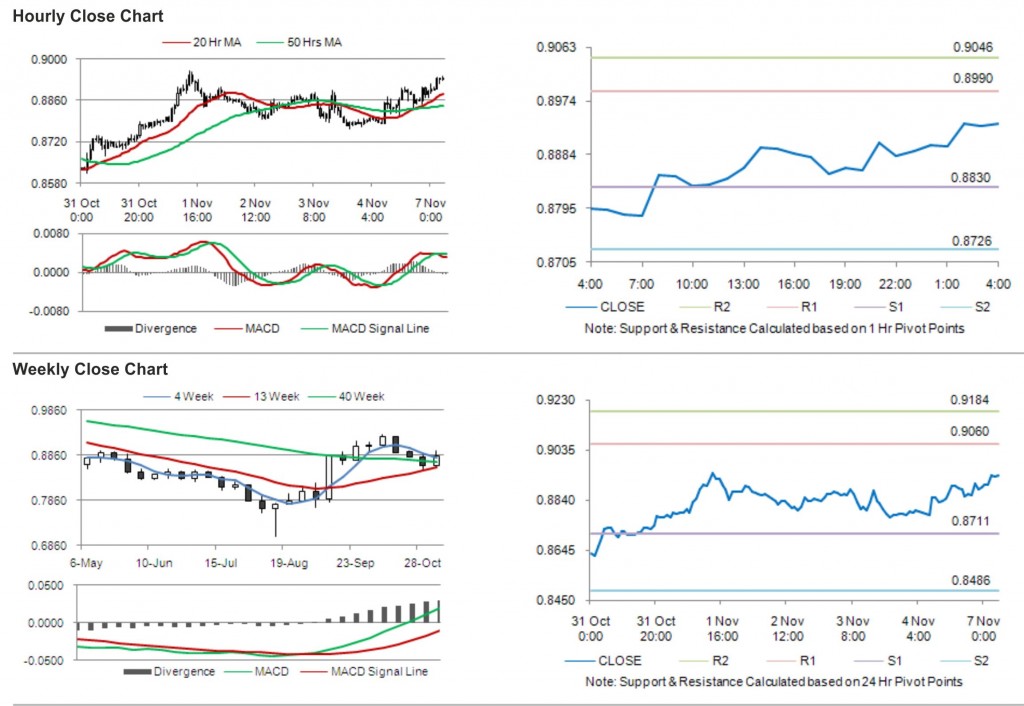

The pair is expected to find support at 0.8830, and a fall through could take it to the next support level of 0.8726. The pair is expected to find its first resistance at 0.8990, and a rise through could take it to the next resistance level of 0.9046.

Trading trends in the pair today are expected to be determined by release of unemployment rate data and Consumer Price Index (CPI) in Switzerland.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.