For the 24 hours to 23:00 GMT, the USD declined marginally against the CHF and closed at 0.8941.

In economic news, the Swiss Bankers Association, following SNB’s and the IMF’s repeated warning, agreed to curbed some of its lending measures, aimed “to a calming and stabilisation of potential hotspots in the real estate market.” Separately, data showed that Switzerland’s merchandise trade surplus widened to CHF2,774.0 million in May, from a revised surplus of CHF2,448.0 million in the earlier month.

In the Asian session, at GMT0300, the pair is trading at 0.8941, with the USD trading flat from yesterday’s close.

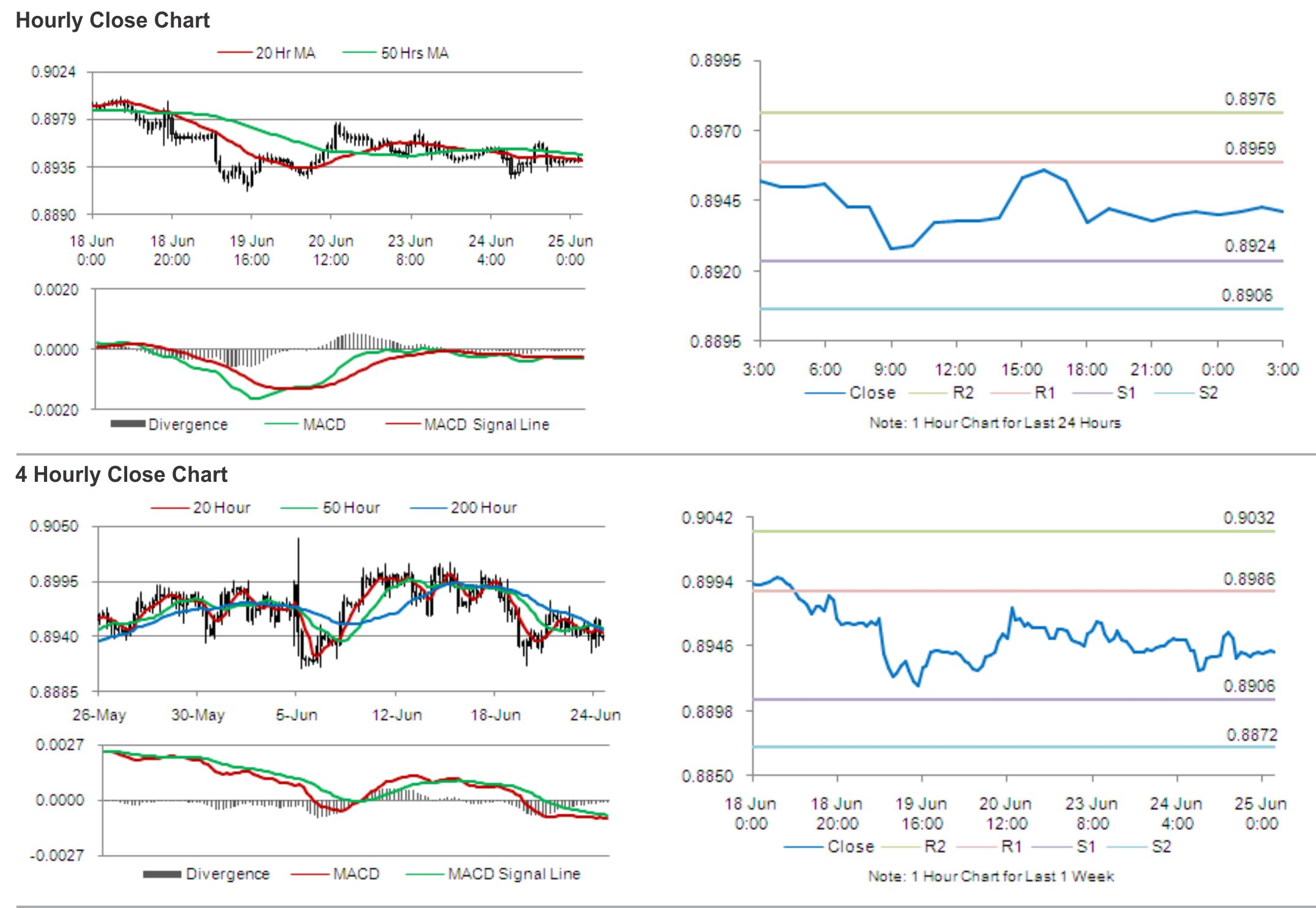

The pair is expected to find support at 0.8924, and a fall through could take it to the next support level of 0.8906. The pair is expected to find its first resistance at 0.8959, and a rise through could take it to the next resistance level of 0.8976.

Market participants keenly await the release of the Swiss May UBS consumption indicator, for further guidance in the Swiss Franc.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.