For the 24 hours to 23:00 GMT, USD declined 0.80% against the CHF and closed at 0.9180.

The consumer price inflation in Switzerland advanced to 1.0% (Y-o-Y) in March, compared to a 0.5% rate in February. Moreover, the monthly consumer price inflation rose to 0.6% in March, from a 0.5% rate in the previous month.

Swiss National Bank board member, Jean-Pierre Danthine stated that an interest-rate increase by the European Central Bank would give Switzerland leeway in deciding its own policy.

In the Asian session, at 3:00GMT, the pair is trading at 0.9187, 0.08% higher from the New York session close.

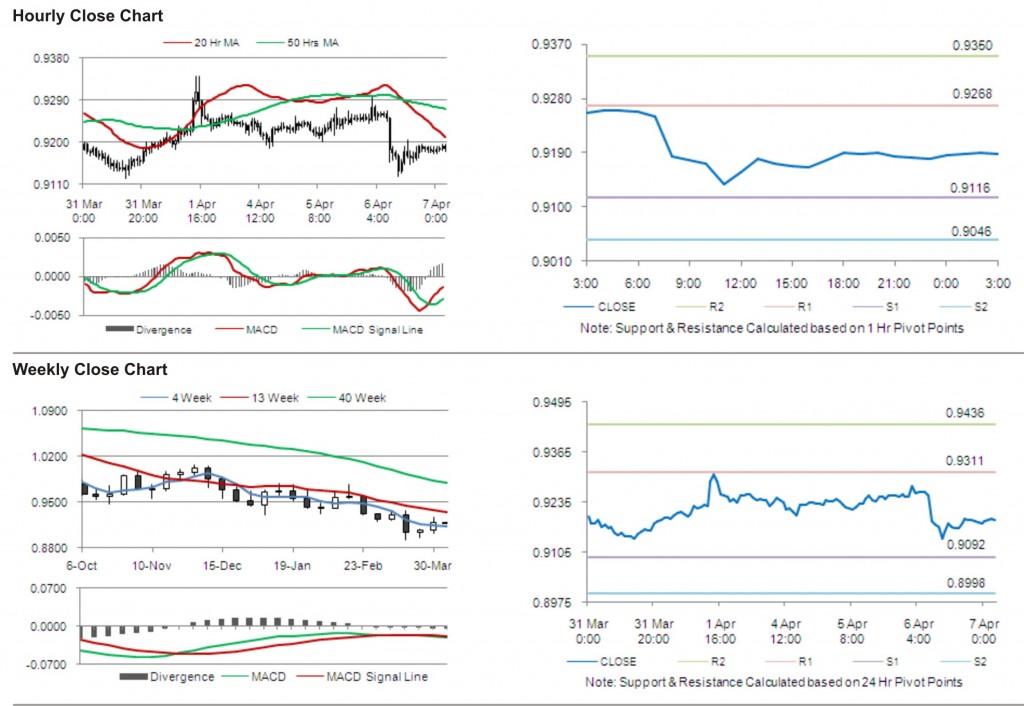

The pair has its first short term resistance at 0.9268, followed by the next resistance at 0.9350. The first area of support is at 0.9116 levels, with the subsequent support at 0.9046.

The Switzerland economic calendar being almost empty today, the pair is expected to ride on other market cues against the greenback.

The currency pair is trading just below its 20 Hr and is trading far below its 50 Hr moving average.