For the 24 hours to 23:00 GMT, the USD rose 0.33% against the CHF and closed at 0.9824.

Macroeconomic data indicated that, Switzerland’s consumer price index fell less-than-expected by 0.4% on a monthly basis in July, compared to an advance of 0.1% in the previous month while markets expected the consumer price index to ease by 0.5%. Also, the nation’s total sight deposits fell slightly to a level of CHF511.37 billion for the week ended 05 August, from CHF511.4 billion for the previous week.

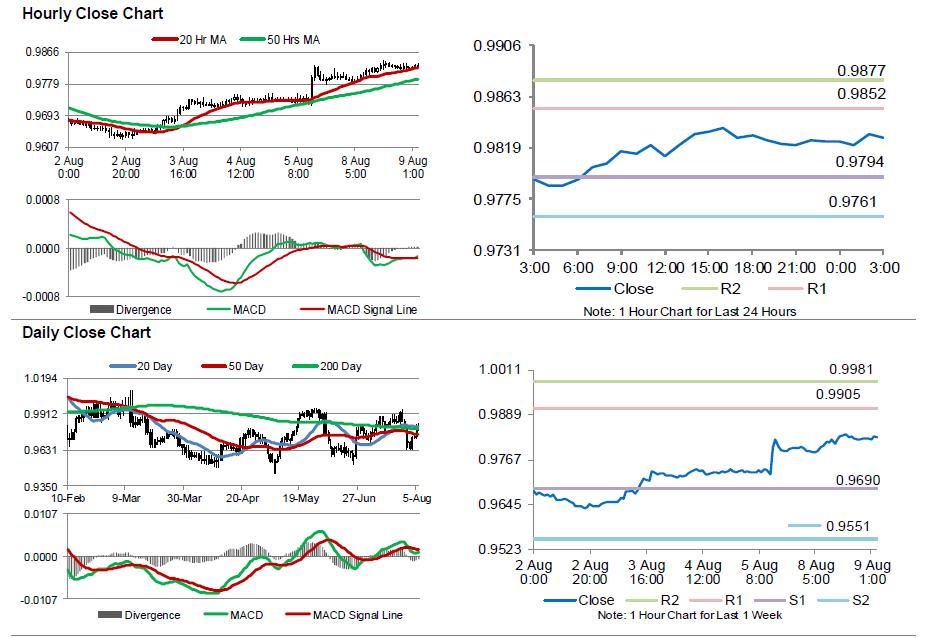

In the Asian session, at GMT0300, the pair is trading at 0.9828, with the USD trading marginally higher against the CHF from yesterday’s close.

The pair is expected to find support at 0.9794, and a fall through could take it to the next support level of 0.9761. The pair is expected to find its first resistance at 0.9852, and a rise through could take it to the next resistance level of 0.9877.

Investors would now focus on Switzerland’s unemployment rate data for July, which is widely expected to remain steady at 3.3%, set to release in some time.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.