For the 24 hours to 23:00 GMT, the USD declined 0.28% against the CHF and closed at 0.9583.

The Swiss Franc gained ground against the USD, as heightened tensions between North Korea and the US stoked demand for safe-haven currency.

In economic news, Switzerland’s total sight deposits inched down to a level of CHF579.2 billion in the week ended 01 September, compared to a level of CHF579.8 billion in the previous week.

In the Asian session, at GMT0300, the pair is trading at 0.9555, with the USD trading 0.29% lower against the CHF from yesterday’s close.

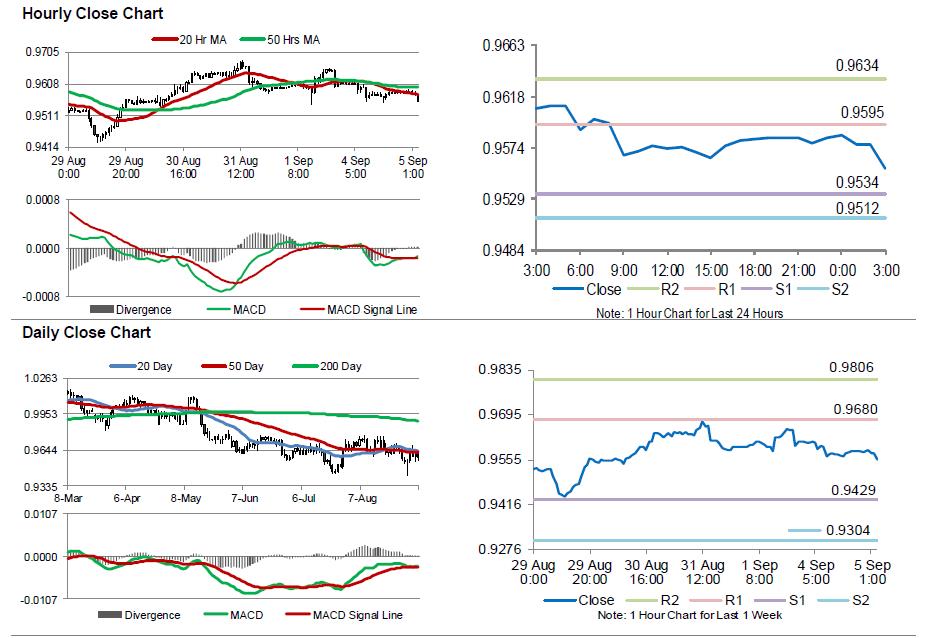

The pair is expected to find support at 0.9534, and a fall through could take it to the next support level of 0.9512. The pair is expected to find its first resistance at 0.9595, and a rise through could take it to the next resistance level of 0.9634.

Ahead in the day, all eyes will be on Switzerland’s 2Q GDP and consumer price inflation data for August.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.