For the 24 hours to 23:00 GMT, the USD declined 0.12% against the CHF and closed at 0.9915.

The Swiss Franc gained ground, after Switzerland’s UBS consumption indicator advanced to a level of 1.47 in April, driven by strong performance in the nation’s automotive and tourism sector. The indicator had registered a revised level of 1.40 in the previous month. Additionally, the ZEW economic expectations index rose to a level of 17.5 in May, from a reading of 11.5 in the prior month.

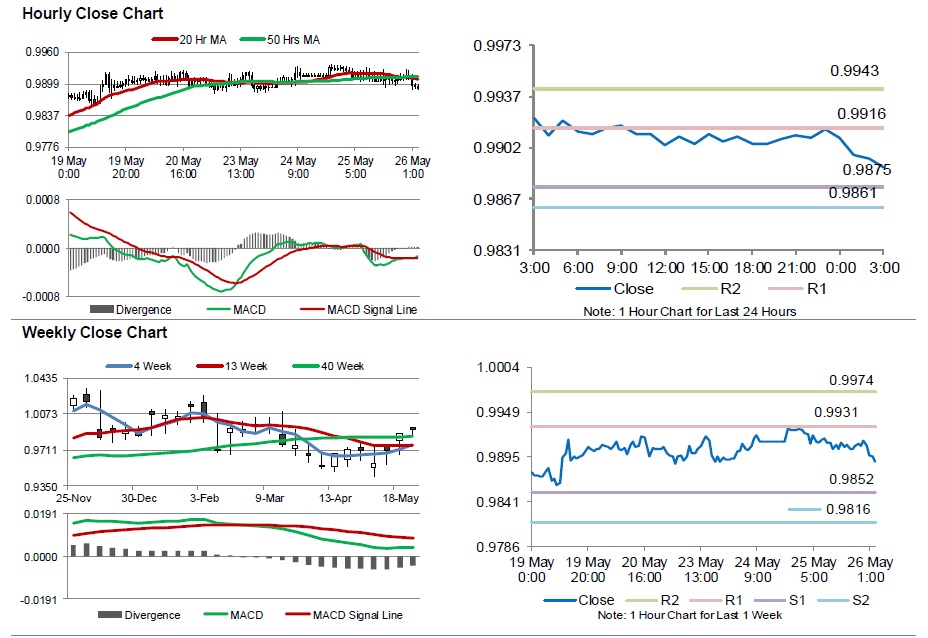

In the Asian session, at GMT0300, the pair is trading at 0.9889, with the USD trading 0.26% lower from yesterday’s close.

The pair is expected to find support at 0.9875, and a fall through could take it to the next support level of 0.9861. The pair is expected to find its first resistance at 0.9916, and a rise through could take it to the next resistance level of 0.9943.

Moving ahead, investors will look forward to Switzerland’s Q1 industrial production data, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.