For the 24 hours to 23:00 GMT, the USD rose 1.20% against the CHF and closed at 0.9371.

Yesterday, the SNB’s Vice-Chairman, Jean-Pierre Danthine, mentioned that the central bank is aware of the risks posed by negative interest rates implemented by it four months ago, to tame a surge in the Franc over time but added that the move is not a “permanent feature” of the economy.

In the Asian session, at GMT0300, the pair is trading at 0.9365, with the USD trading 0.07% lower from yesterday’s close.

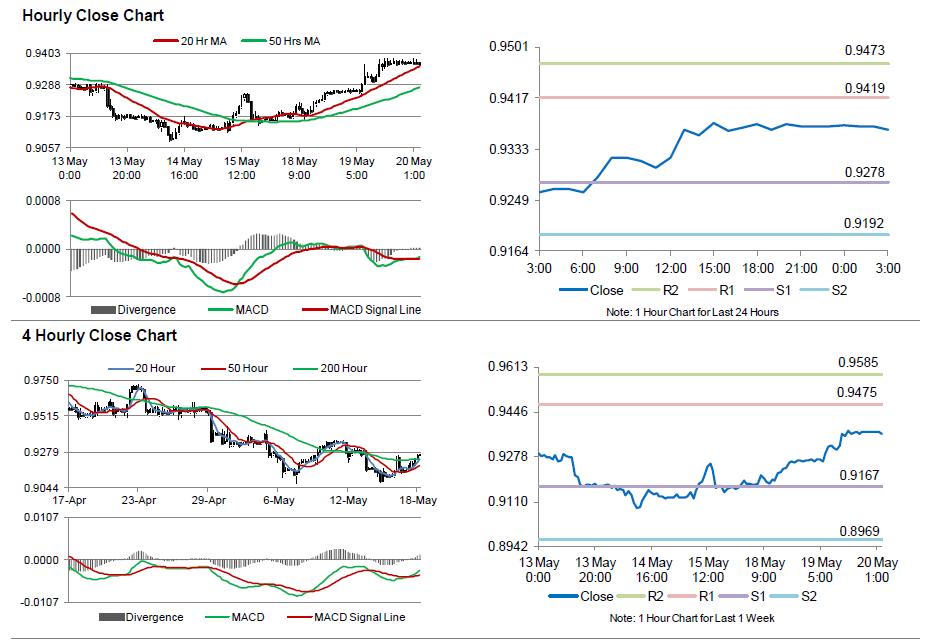

The pair is expected to find support at 0.9278, and a fall through could take it to the next support level of 0.9192. The pair is expected to find its first resistance at 0.9419, and a rise through could take it to the next resistance level of 0.9473.

Looking ahead, investors would closely watch Switzerland’s ZEW survey, set for release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.