For the 24 hours to 23:00 GMT, the USD declined 1.09% against the CHF and closed at 0.9218.

On the macro front, Switzerland’s ZEW’s economic expectation index advanced to a level of 0.1 in June, following a reading of -0.1 recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 0.9203, with the USD trading 0.16% lower from yesterday’s close.

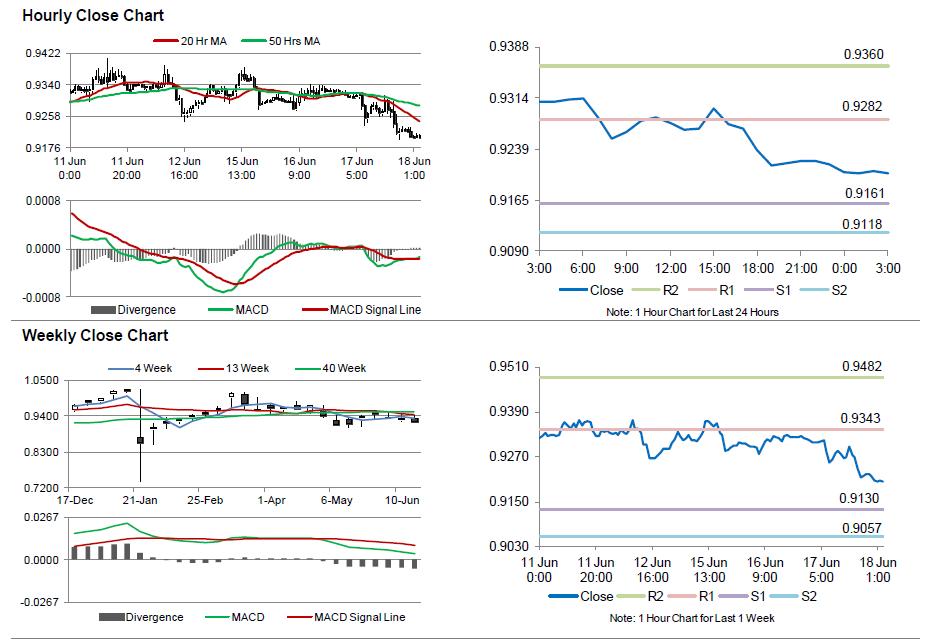

The pair is expected to find support at 0.9161, and a fall through could take it to the next support level of 0.9118. The pair is expected to find its first resistance at 0.9282, and a rise through could take it to the next resistance level of 0.9360.

Going forward, the SNB’s interest rate decision, scheduled later today would keep investors on their toes albeit it is widely expected that the Swiss central bank will keep key interest rates unchanged.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.