For the 24 hours to 23:00 GMT, the USD rose 0.39% against the CHF and closed at 0.9827.

The Swiss Franc weakened after Vice President of the Swiss National Bank, Fritz Zurbruegg, stated that the Swiss Franc still remains overvalued and added that the central bank will closely monitor the impact of ECB’s stimulus measures on the Swiss economy, hinting at the likelihood of further intervention by the SNB in the forex market.

In other economic news, Switzerland’s total sight deposits inched up to CHF467.0 billion in the week ended 23 October from CHF465.9 billion in the previous week.

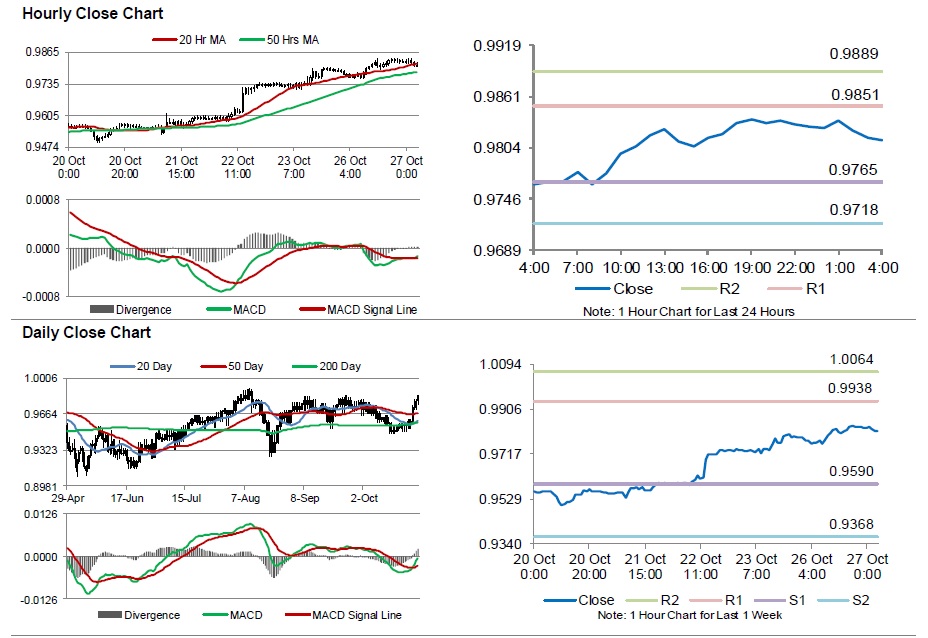

In the Asian session, at GMT0400, the pair is trading at 0.9813, with the USD trading 0.15% lower from yesterday’s close.

The pair is expected to find support at 0.9765, and a fall through could take it to the next support level of 0.9718. The pair is expected to find its first resistance at 0.9851, and a rise through could take it to the next resistance level of 0.9889.

Going ahead, market participants will look forward to Switzerland’s UBS consumption indicator for September, scheduled to be released in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.