For the 24 hours to 23:00 GMT, the USD declined 0.57% against the CHF and closed at 0.9859.

Macroeconomic data indicated that, Switzerland’s UBS consumption indicator edged up to a level of 1.34 in June, following a revised level of 1.24 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 0.9853, with the USD trading 0.06% lower against the CHF from yesterday’s close.

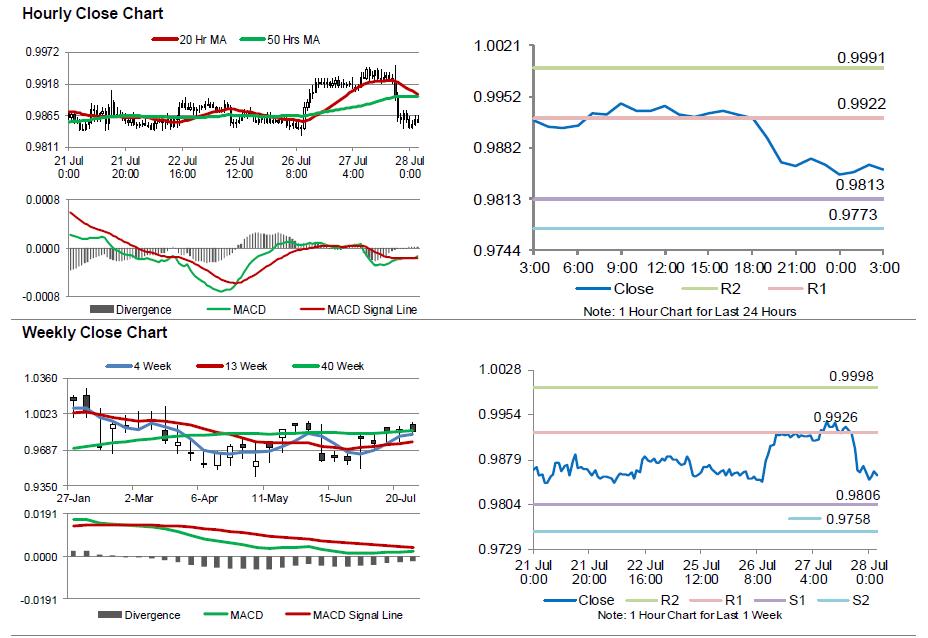

The pair is expected to find support at 0.9813, and a fall through could take it to the next support level of 0.9773. The pair is expected to find its first resistance at 0.9922, and a rise through could take it to the next resistance level of 0.9991.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.