For the 24 hours to 23:00 GMT, USD rose 0.16% against the CHF, on Friday, and closed at 0.7670.

In the US economic news, the consumer credit increased by $15.5 billion in June, the biggest gain since August 2007, following a $5.08 billion increase recorded in May. Additionally, in the Swiss economic news, the Swiss National Bank’s currency reserves declined to CHF182.08 billion in July, compared to a foreign currency reserve of CHF196.3 billion recorded in June. The consumer price inflation, on an annual basis, slowed to 0.5% in July, compared to a rate of 0.6% recorded in June.

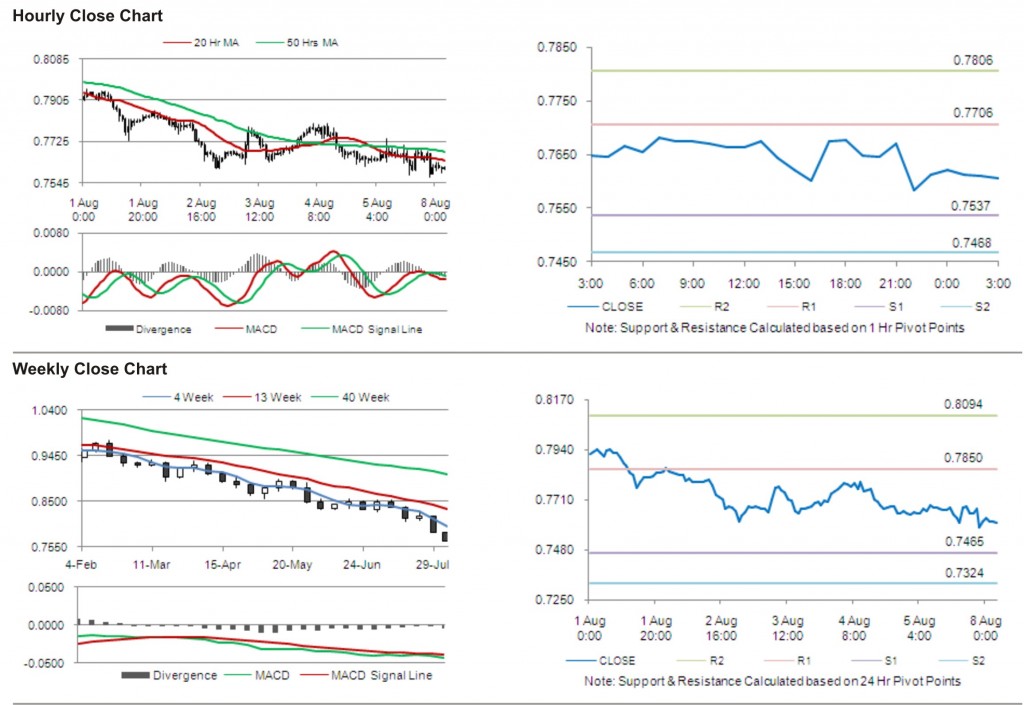

In the Asian session, at 3:00GMT, the pair is trading at 0.7605, 0.85% lower from Friday’s close at 23:00 GMT.

The pair has its first short term resistance at 0.7706, followed by the next resistance at 0.7806. The first area of support is at 0.7537 level, with the subsequent support at 0.7468.

Trading trends in the pair today are expected to be determined by release of unemployment rate data in Switzerland.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.