For the 24 hours to 23:00 GMT, the USD rose 0.82% against the CHF and closed at 0.9528, as the US new home sales and consumer confidence data revealed upbeat figures. The Swiss Franc came under pressure, after number of people employed in Switzerland dropped to 4.22 million in Q1 2015, compared to market expectations of a drop to 4.21 million. The number of people employed had registered a reading of 4.23 million in the previous quarter.

In the Asian session, at GMT0300, the pair is trading at 0.9521, with the USD trading 0.06% lower from yesterday’s close.

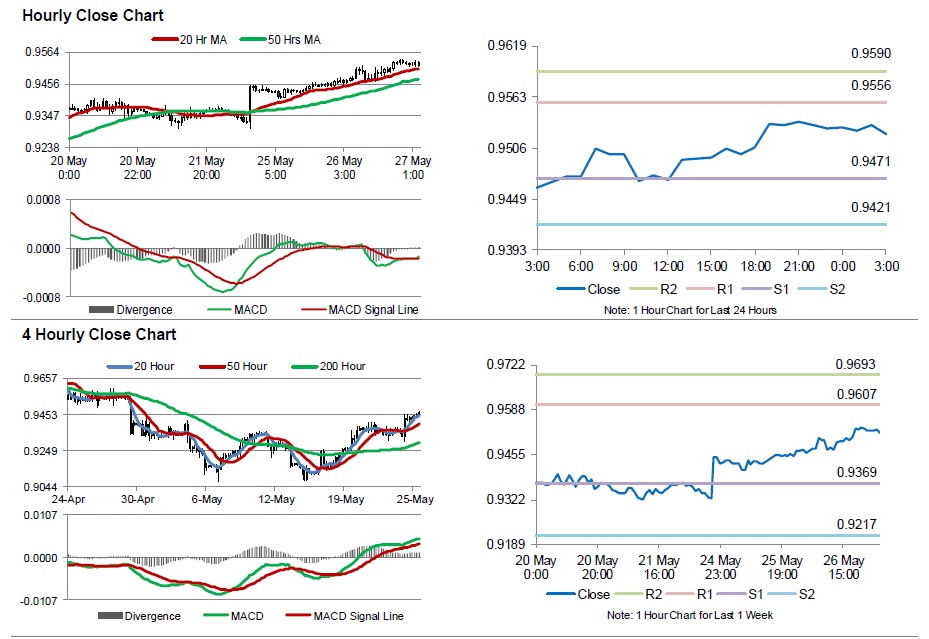

The pair is expected to find support at 0.9471, and a fall through could take it to the next support level of 0.9421. The pair is expected to find its first resistance at 0.9556, and a rise through could take it to the next resistance level of 0.959.

Meanwhile, market participants would monitor Switzerland’s UBS consumption indicator data, scheduled in a few hours for further direction in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.