On Friday, the USD declined 0.44% against the CHF and closed at 0.9518, after the US consumer prices rose less than expected on a monthly basis in March.

On the macro front, real retail sales in Switzerland eased 2.70% on an annual basis in February. It had fallen 0.30% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 0.9525, with the USD trading 0.07% higher from Friday’s close.

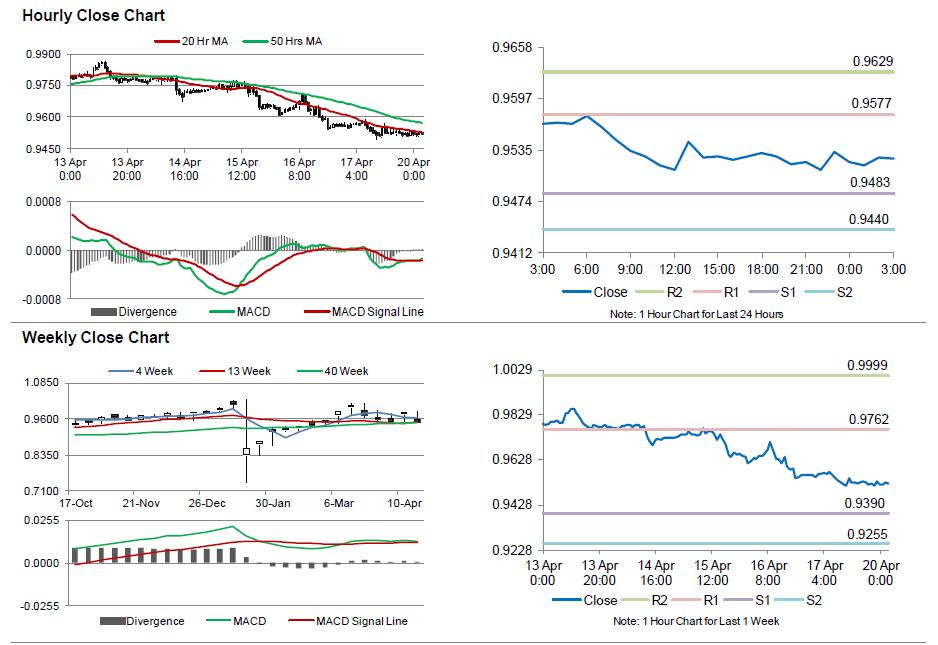

The pair is expected to find support at 0.9483, and a fall through could take it to the next support level of 0.944. The pair is expected to find its first resistance at 0.9577, and a rise through could take it to the next resistance level of 0.9629.

Amid no economic releases in Switzerland today, investors await ZEW survey data, scheduled later in the week.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.