For the 24 hours to 23:00 GMT, USD rose 0.11% against the CHF and closed at 0.9195.

In Switzerland, the Swiss National Bank reported that current account indicated a surplus of CHF19.4 billion in 4Q FY2010, from a surplus of CHF21.9 billion in the 3Q FY2010. Additionally, surplus in goods account came in stable at CHF3.9 billion in the 4Q FY2010. Also, the net surplus of labor and investment account totaled CHF6.7 billion in the 4Q FY2010.

In the Asian session, at 3:00GMT, the pair is trading at 0.9205, 0.11% higher from the New York session close.

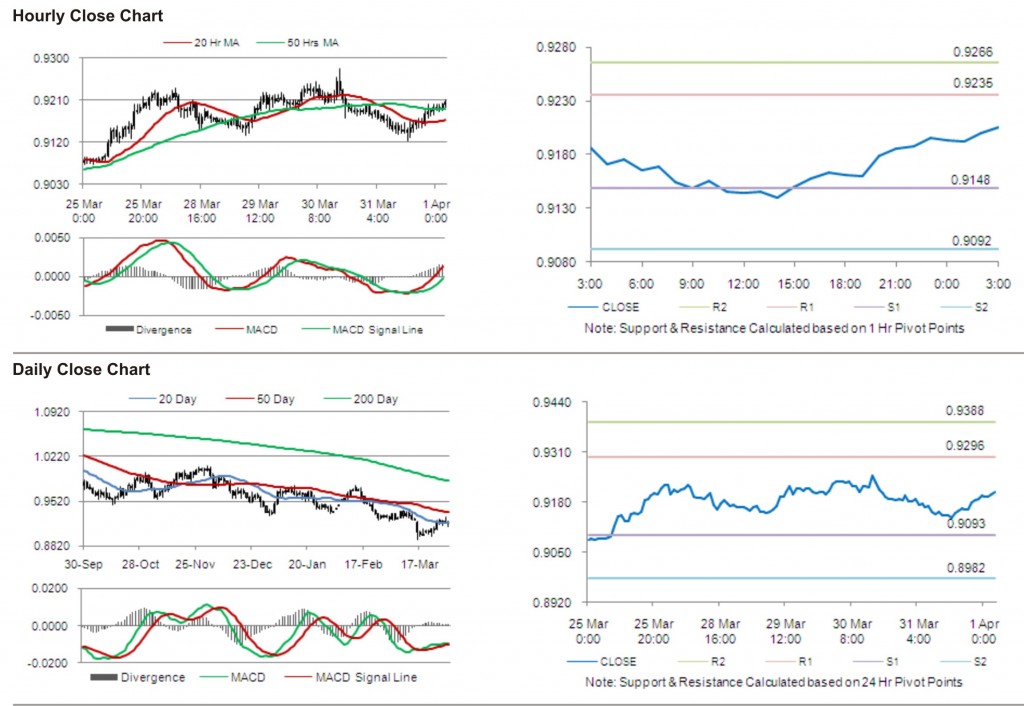

The pair has its first short term resistance at 0.9235, followed by the next resistance at 0.9266. The first area of support is at 0.9148 levels, with the subsequent support at 0.9092.

Trading trends in the pair today are expected to be determined by release of SVME – purchasing managers’ index in Switzerland.

The currency pair is showing convergence with 50 Hr moving average and is trading above its 20 Hr moving average.