For the 24 hours to 23:00 GMT, USD declined 1.21% against the CHF and closed at 0.8703.

In Switzerland, trade surplus increased to CHF5.45 billion in the first quarter of 2011, compared to the trade surplus of CHF5.29 billion recorded in the same period last year. Meanwhile, the UBS bank reported that its consumption indicator for Switzerland rose to 1.66 in March compared to 1.46 in February.

In the Asian session, at 3:00GMT, the pair is trading at 0.8725, 0.25% higher from the New York session close.

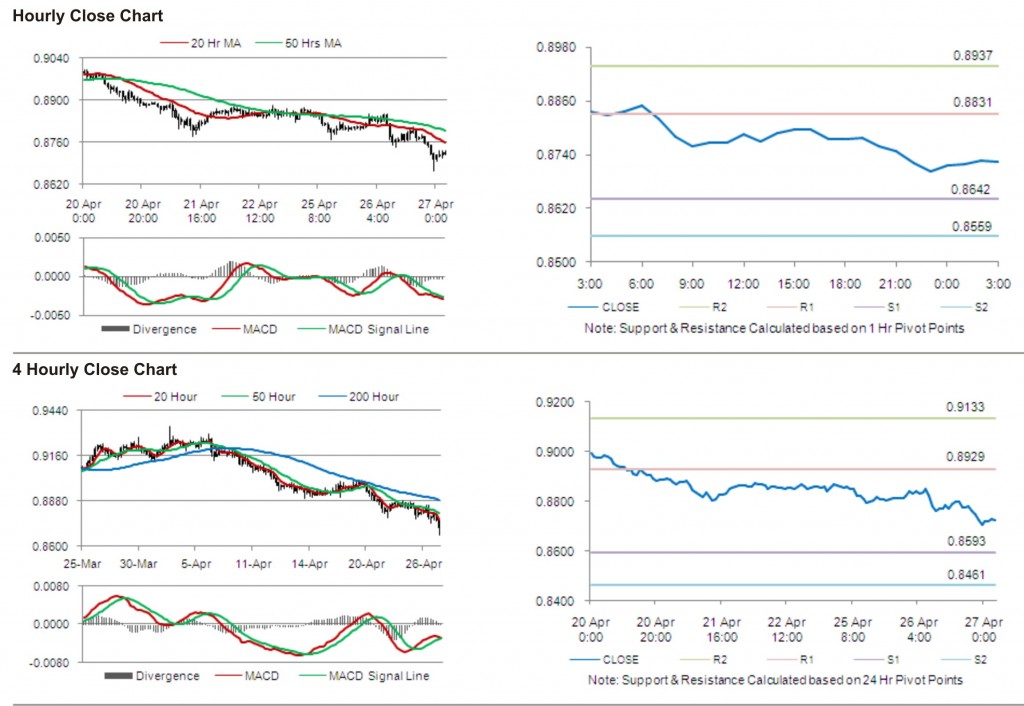

The pair has its first short term resistance at 0.8831, followed by the next resistance at 0.8937. The first area of support is at 0.8642 levels, with the subsequent support at 0.8559.

With no major release from Switzerland, the pair is expected to trade on trends in the greenback.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.