For the 24 hours to 23:00 GMT, the USD rose 0.82% against the CHF and closed at 0.9498, following better than expected initial jobless claims data in the US.

On the macro front, Swiss trade surplus unexpectedly widened to CHF3.43 billion in January, compared to a revised trade surplus of CHF1.51 billion registered in the prior month. Markets were expecting it to drop to a level of CHF 1.20 billion.

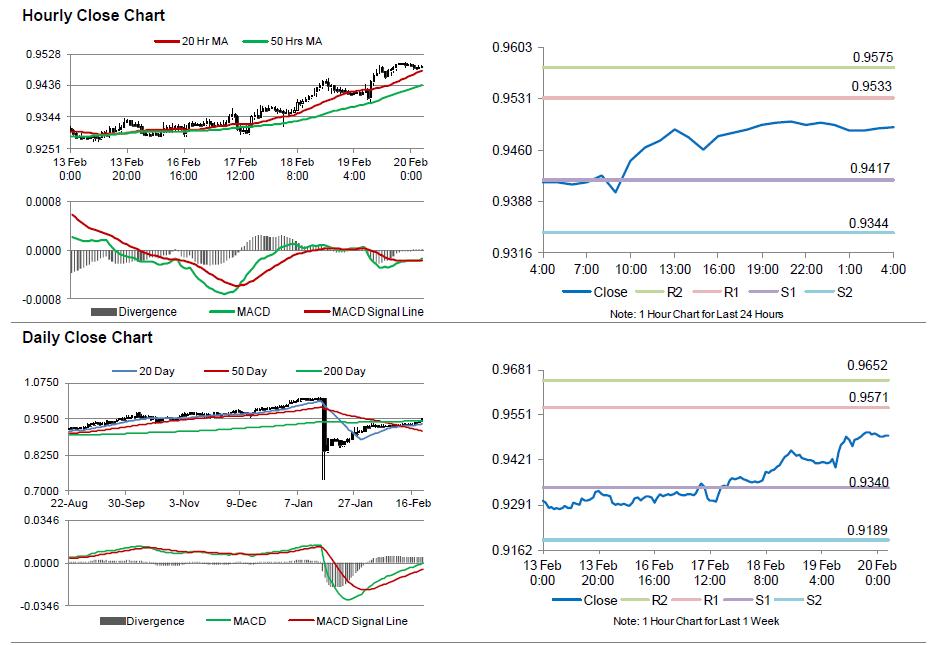

In the Asian session, at GMT0400, the pair is trading at 0.9491, with the USD trading 0.07% lower from yesterday’s close.

The pair is expected to find support at 0.9417, and a fall through could take it to the next support level of 0.9344. The pair is expected to find its first resistance at 0.9533, and a rise through could take it to the next resistance level of 0.9575.

Amid no economic releases in Switzerland today, investors await the release of Switzerland’s UBS consumption indicator data, scheduled on Wednesday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.