For the 24 hours to 23:00 GMT, the USD rose 0.63% against the CHF and closed at 0.9492.

In economic news, Switzerland’s trade surplus widened to CHF 2.45 billion in September, lower than market expectations of a trade surplus of CHF 2.49 billion and compared to a revised trade surplus of CHF 1.33 billion in the prior month.

In other economic data, the SNB reported that M3 money supply in Switzerland advanced 3.4% on a YoY basis in September, following a revised rise of 3.3% registered in the previous month.

Separately, the SNB’s Board Member, Fritz Zurbruegg stated that the Swiss Franc was still elevated and hence the central bank would extend its Cap on the Swiss Franc, while further adding that the central bank would take further measures if required.

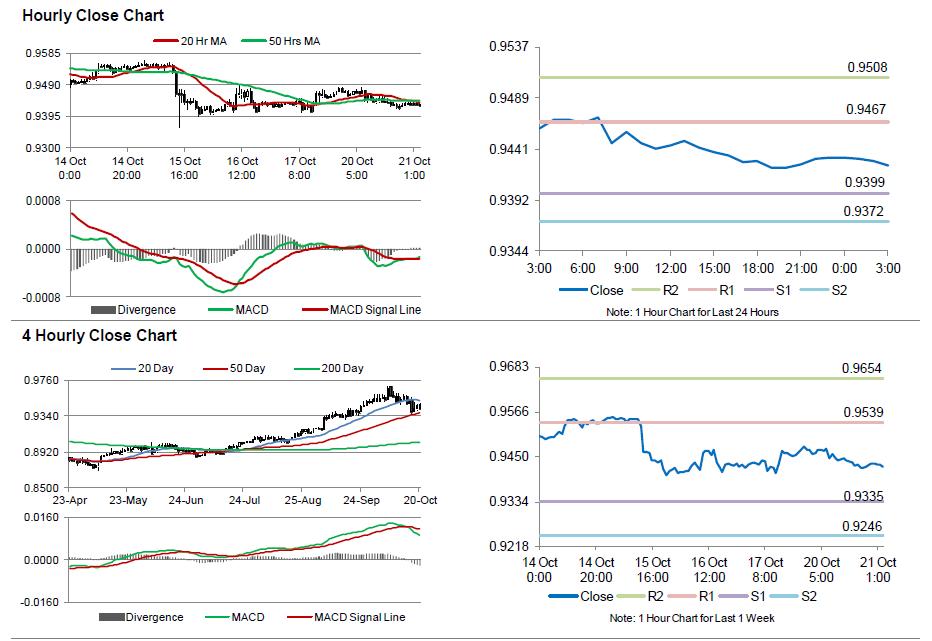

In the Asian session, at GMT0300, the pair is trading at 0.9483, with the USD trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 0.9421, and a fall through could take it to the next support level of 0.9359. The pair is expected to find its first resistance at 0.9522, and a rise through could take it to the next resistance level of 0.9561.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.