For the 24 hours to 23:00 GMT, the USD rose 1.24% against the CHF and closed at 0.9738.

Following the United Kingdom’s vote to leave the European Union, the Swiss National Bank (SNB) intervened in the nation’s foreign exchange market to stabilise the situation and indicated that the central bank will remain active in the in the market until it had shaken out the excess volatility. Separately, the Swiss President, Johann Schneider-Ammann, warned that the British vote to leave the European Union will have a negative impact on the Swiss economy, amid a strengthening of the domestic currency.

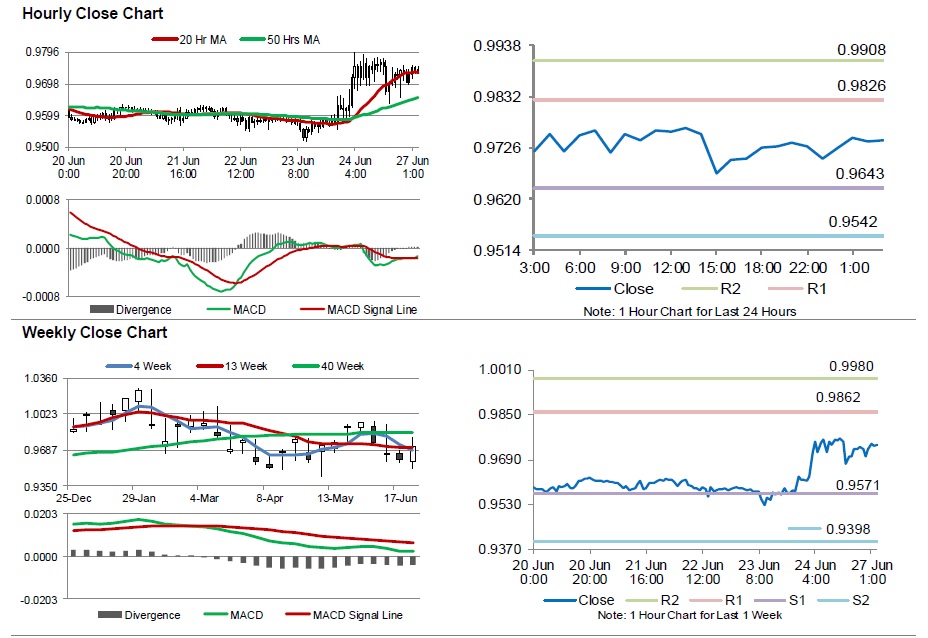

In the Asian session, at GMT0300, the pair is trading at 0.9743, with the USD trading marginally higher against the CHF from Friday’s close.

The pair is expected to find support at 0.9643, and a fall through could take it to the next support level of 0.9542. The pair is expected to find its first resistance at 0.9826, and a rise through could take it to the next resistance level of 0.9908.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.