For the 24 hours to 23:00 GMT, the USD declined 0.16% against the CHF and closed at 0.9652.

In economic news, Switzerland’s UBS consumption indicator rose to a level of 1.53 in February, led by consistent and robust growth in private consumption. The indicator had registered a revised reading of 1.45 in the previous month. Additionally, the nation’s KOF leading indicator fell less-than-expected to a level of 102.5 in March, from a revised level of 102.6 in the prior month. Markets were expecting it to fall to a level of 102.0.

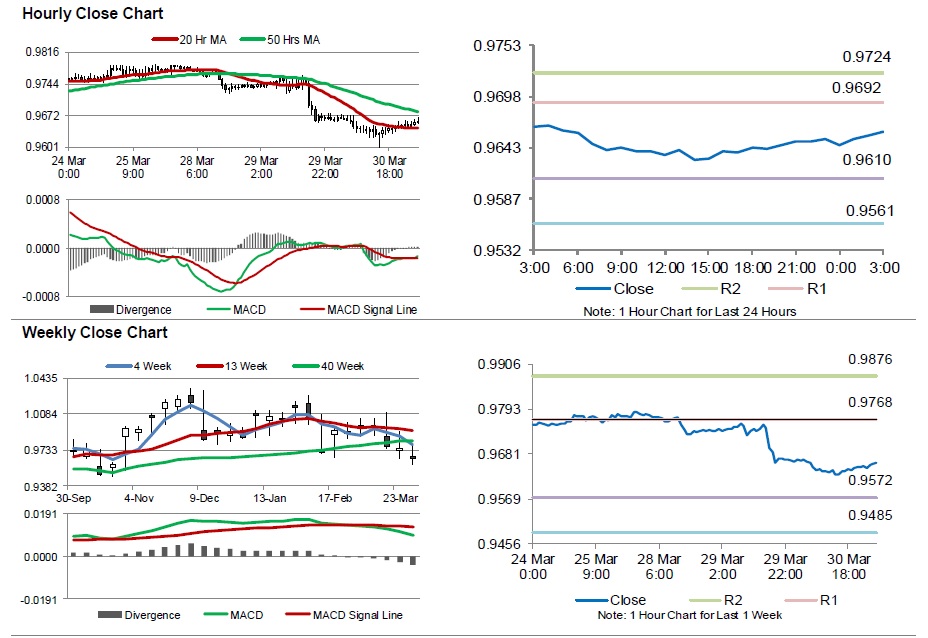

In the Asian session, at GMT0300, the pair is trading at 0.966, with the USD trading 0.08% higher from yesterday’s close.

The pair is expected to find support at 0.9610, and a fall through could take it to the next support level of 0.9561. The pair is expected to find its first resistance at 0.9692, and a rise through could take it to the next resistance level of 0.9724.

Moving ahead, investors will look forward to Switzerland’s real retail sales and SVME purchasing managers index data, scheduled to release tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.