For the 24 hours to 23:00 GMT, the USD declined 0.90% against the CHF and closed at 0.9560, on the back of an unexpected increase in the US initial jobless claims data.

In economic news, the producer and import price index in Switzerland surprisingly rebounded 0.2% on a monthly basis in March, beating market expectations for a steady reading. The index had fallen 1.4% in the previous month.

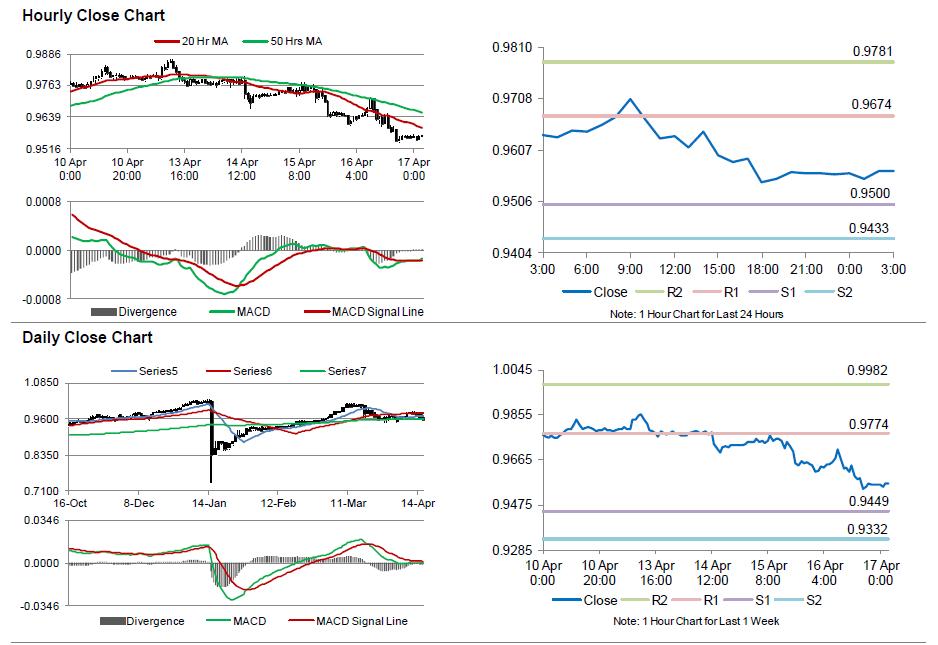

In the Asian session, at GMT0300, the pair is trading at 0.9567, with the USD trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 0.9500, and a fall through could take it to the next support level of 0.9433. The pair is expected to find its first resistance at 0.9674, and a rise through could take it to the next resistance level of 0.9781.

Looking ahead, investors await Switzerland’s real retail sales data, set for release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.