For the 24 hours to 23:00 GMT, USD rose 9.75% against the CHF and closed at 0.8614.

In Switzerland, the Swiss National Bank (SNB) announced a floor against the euro of CHF1.20 to the EUR as a minimum exchange rate. The central bank stated that the intervention would be “enforced with the utmost determination” and also added that it is prepared to buy foreign currency in unlimited quantities.

In Switzerland, consumer price inflation slowed to 0.2% (Y-o-Y) in August, following a rate of 0.5% in July. Additionally, the SNB reported that foreign currency reserves edged up to CHF253.35 billion in August, from CHF182.07 billion in July.

In the Asian session, at 3:00GMT, the USD is trading at 0.8582, 0.37% lower versus Swiss Franc, from yesterday’s close at 23:00 GMT.

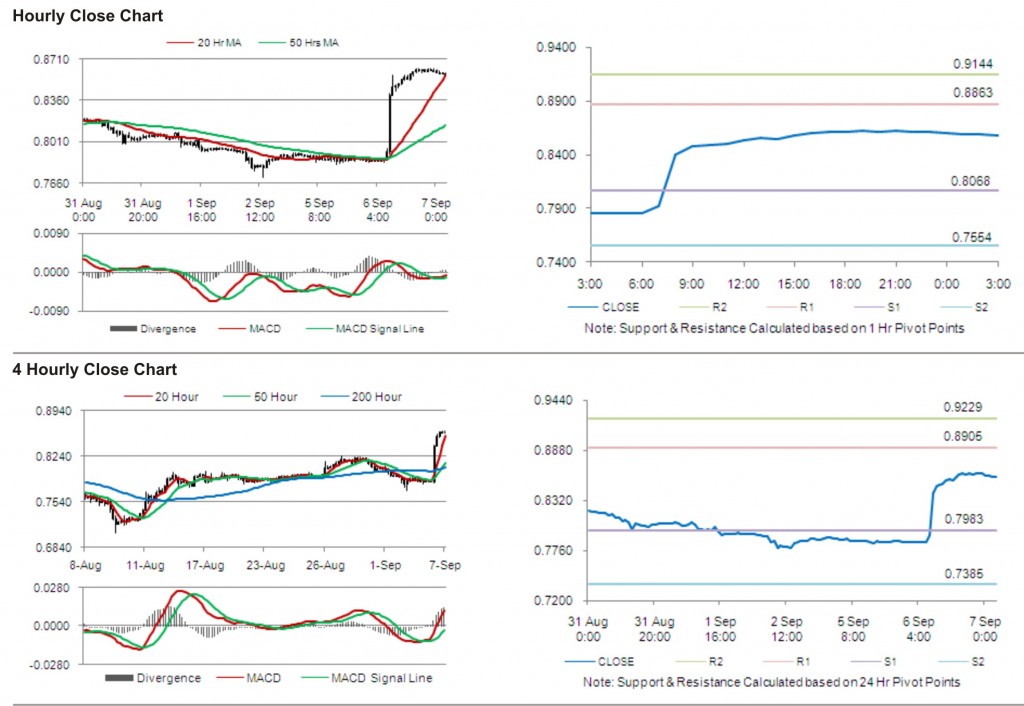

The pair has its first short term resistance at 0.8863, followed by the next resistance at 0.9144. The first area of support is at 0.8068 level, with the subsequent support at 0.7554.

The currency pair is showing convergence with its 20 Hr moving average and is trading above 50 Hr moving average.