For the 24 hours to 23:00 GMT, the USD rose 0.47% against the CHF and closed at 0.9022.

The Swiss Franc came under pressure after data showed that the trade surplus in Switzerland narrowed more than expected to CHF1.4 billion in June, compared to a revised surplus of CHF2.9 billion recorded in the previous month. Markets had expected the trade surplus to narrow to CHF2.8 billion in June.

In the Asian session, at GMT0300, the pair is trading at 0.9024, with the USD trading marginally higher from yesterday’s close.

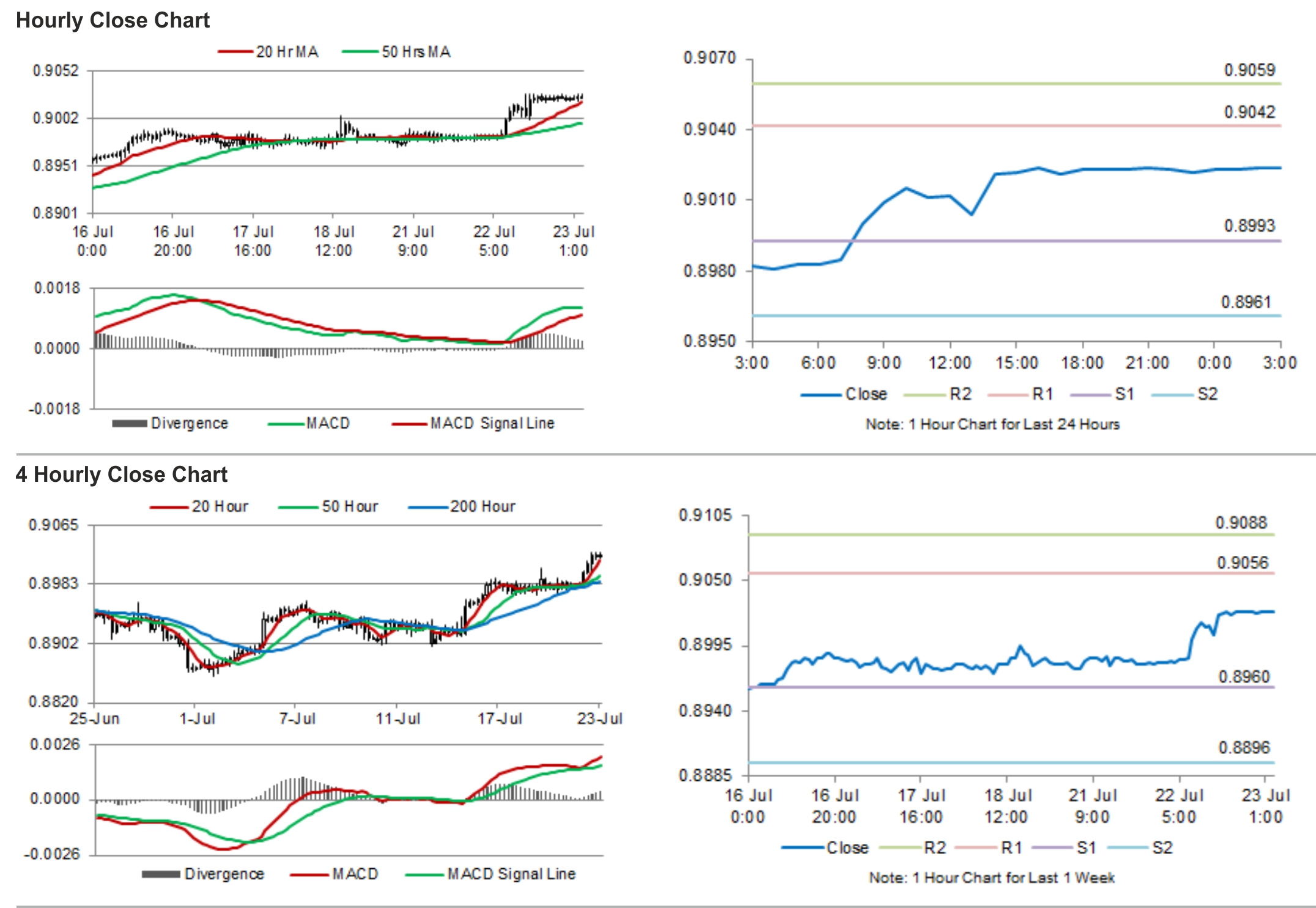

The pair is expected to find support at 0.8993, and a fall through could take it to the next support level of 0.8961. The pair is expected to find its first resistance at 0.9042, and a rise through could take it to the next resistance level of 0.9059.

Amid a lack of releases from Switzerland scheduled today, investors would determine the trading trends for the Swiss Franc from global news.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.