For the 24 hours to 23:00 GMT, the USD rose 0.52% against the CHF and closed at 0.9828.

On the data front, Switzerland’s KOF leading indicator fell more-than-expected to a level of 99.8 in August, hitting an eight-month low level, compared to a revised level of 103.5 in the prior month.

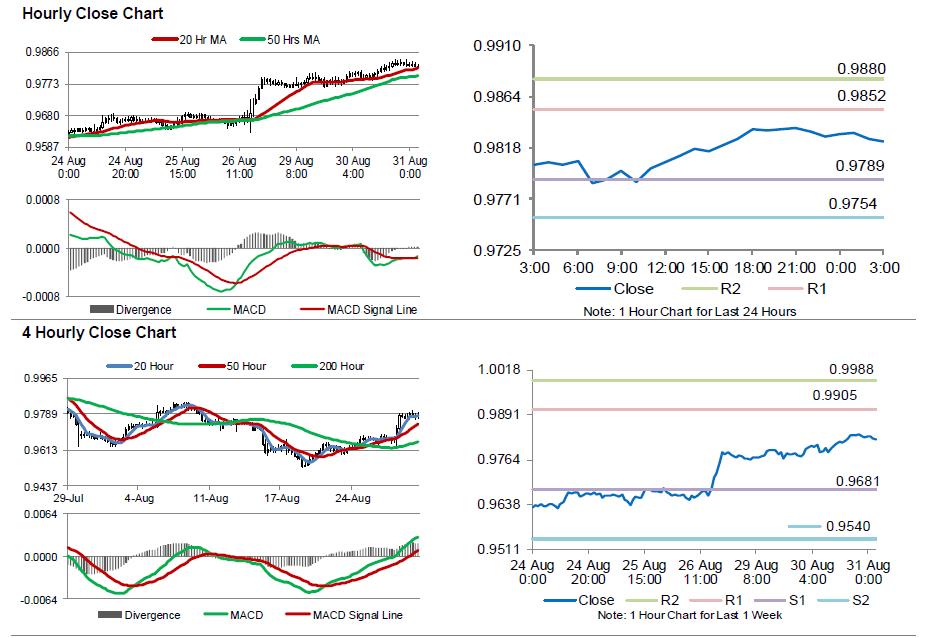

In the Asian session, at GMT0300, the pair is trading at 0.9823, with the USD trading a tad lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9789, and a fall through could take it to the next support level of 0.9754. The pair is expected to find its first resistance at 0.9852, and a rise through could take it to the next resistance level of 0.9880.

Investors would now focus on Switzerland’s UBS consumption indicator data, slated to release in a while.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.