On Friday, the USD rose 0.56% against the CHF and closed at 0.9043, after two of the top Fed officials highlighted the possibility for a further reduction in the size of the central bank’s stimulus package in the comings months.

In Switzerland, the SVME manufacturing purchasing managers index (PMI) declined to a reading of 53.9 in December, worse than market estimates for a fall to 56.3, from previous month’s reading of 56.5. However, the KOF Swiss leading indicator surpassed market expectations and advanced to a level of 1.95 in December, following a reading of 1.85 registered in November.

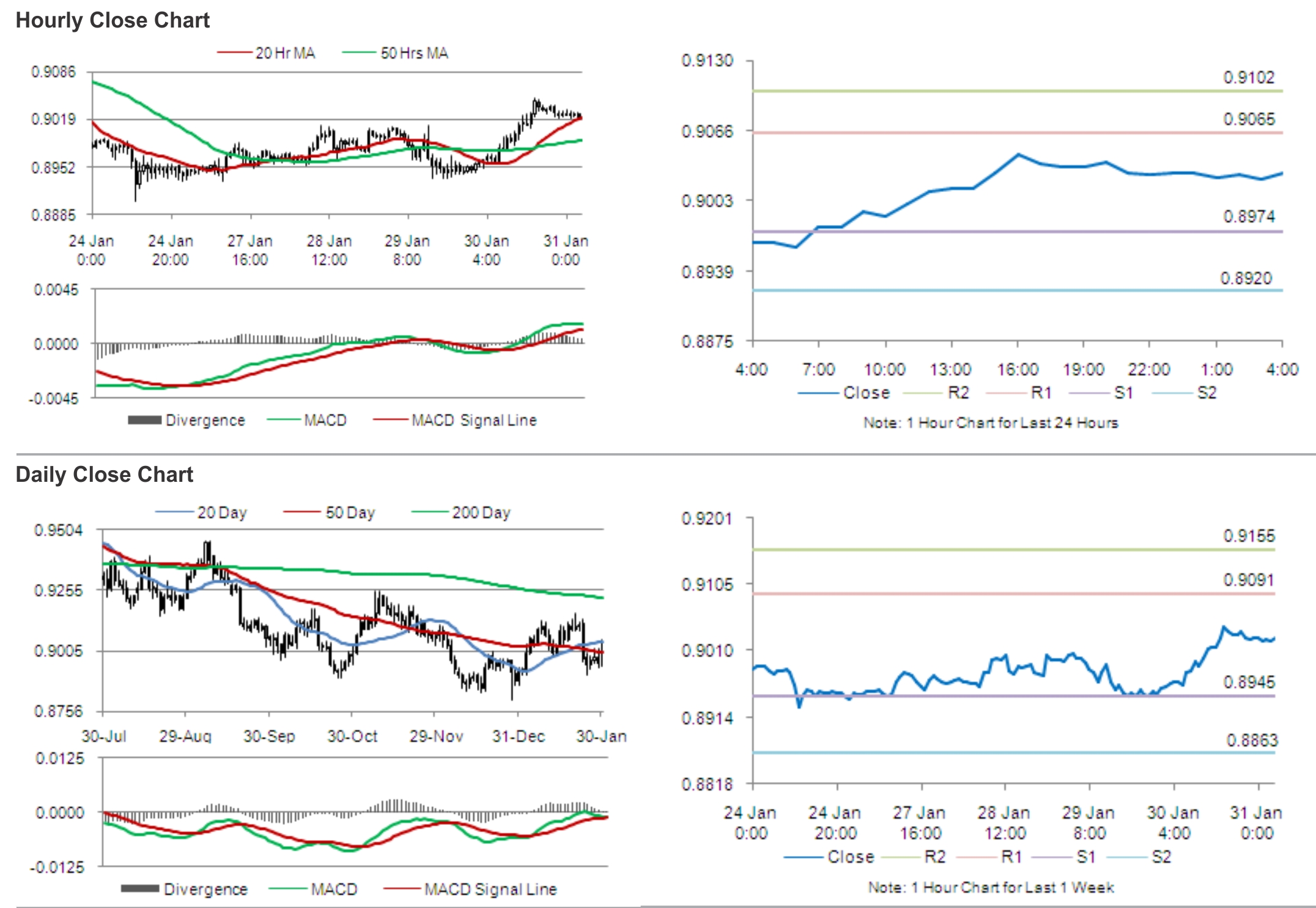

In the Asian session, at GMT0400, the pair is trading at 0.9061, with the USD trading 0.20% higher from Friday’s close.

The pair is expected to find support at 0.9010, and a fall through could take it to the next support level of 0.8960. The pair is expected to find its first resistance at 0.9089, and a rise through could take it to the next resistance level of 0.9118.

Amid lack of economic releases from Switzerland during the later course of the day, traders are expected to keep an eye on global economic news for further guidance in the pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.