For the 24 hours to 23:00 GMT, the USD rose 0.10% against the CHF and closed at 0.9939.

On the data front, Switzerland’s producer and import prices fell 1.7% on a yearly basis in November, more than market expectations for a drop of 1.7%. In the previous month, producer and import prices had recorded a reading of 2.3%.

Meanwhile, the Swiss National Bank kept its key interest rate unchanged at -0.75%, as widely expected. Further, the central bank lowered its inflation forecast for 2019 to 0.5% from 0.8%, citing a stronger franc and downside risks to the economy. Additionally, the bank downgraded its outlook for 2020 to 1.2% from 1.0%. However, the central bank projected a GDP growth of around 2.5% for the current year and nearly 1.5% for the next year.

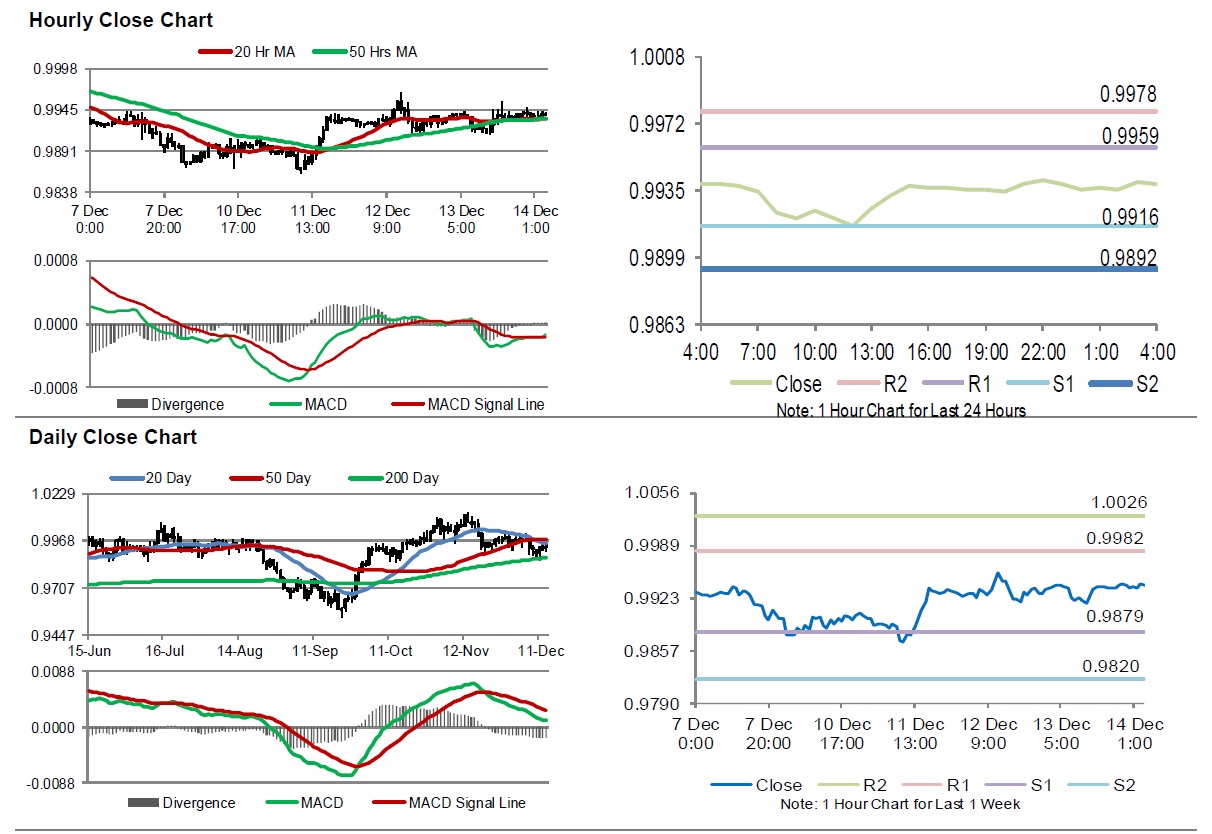

In the Asian session, at GMT0400, the pair is trading at 0.9939, with the USD trading flat against the CHF from yesterday’s close.

The pair is expected to find support at 0.9916, and a fall through could take it to the next support level of 0.9892. The pair is expected to find its first resistance at 0.9959, and a rise through could take it to the next resistance level of 0.9978.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.