For the 24 hours to 23:00 GMT, the USD rose 0.08% against the CHF and closed at 0.9624.

In economic news, Switzerland’s trade surplus widened to a three-month high level of CHF3.79 billion in May, from a revised surplus of CHF2.51 billion. Meanwhile, the nation’s exports fell 0.4% and imports rose 0.2%, on a monthly basis in May.

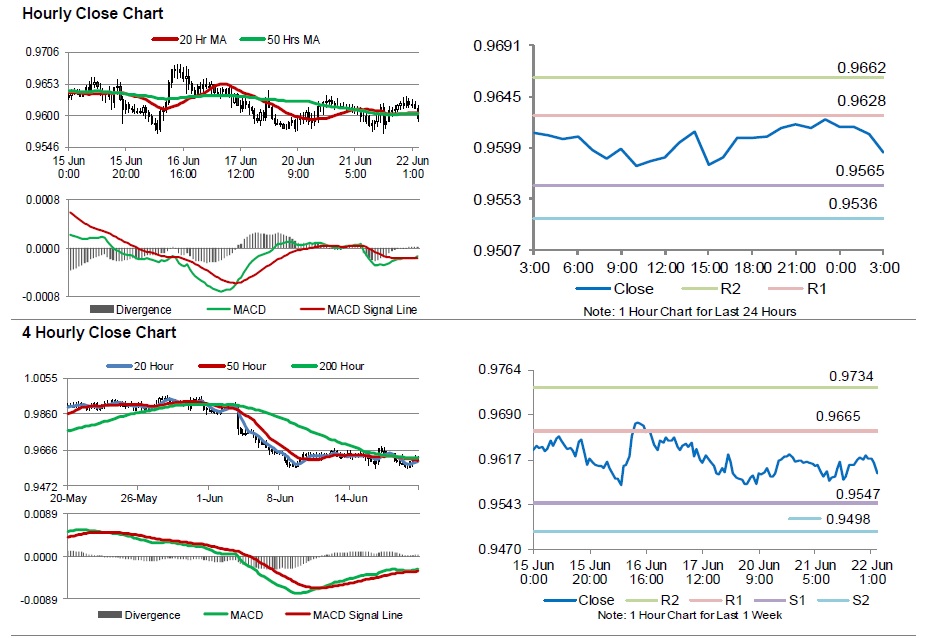

In the Asian session, at GMT0300, the pair is trading at 0.9595, with the USD trading 0.3% lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9565, and a fall through could take it to the next support level of 0.9536. The pair is expected to find its first resistance at 0.9628, and a rise through could take it to the next resistance level of 0.9662.

Going ahead, investors will look forward to Switzerland’s ZEW survey data for June, along with the Swiss National Bank’s Q2 quarterly bulletin report, scheduled to release later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.